Canada’s gold sell-off bucks international trend

THANK YOU FOR POSTING A REVIEW!

Your review was sent successfully and is now waiting for our staff to publish it.

(February 15, 2016 - by Greg Klein)

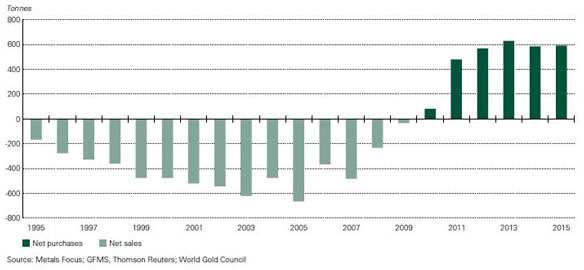

With no help from Canada, central bank gold purchases totalled

588.4 tonnes last year, second only to the 2013 record of 625.5 tonnes.

Chart: World Gold Council

Other countries have been net buyers of gold since 2010, but not Canada. The Great White North has less than one ton left, the CBC reports. Last year’s reserve was modest enough, but still stood at over US$100 million through most of 2015. Recent selling drove the stash down to $19 million by February 8, according to finance ministry figures cited by the network.

They show sales of 41,106 ounces in December and another 32,860 ounces the following month, all in maple leaf coins. That left 21,929 ounces at the end of January, which the Bank of Canada called “negligible,” the CBC stated.

Gold’s recent price spike, which on its February 11 peak had some retailers offering over C$1,780 for one-ounce maple leafs, had nothing to do with the sales, finance ministry spokesperson David Barnabe informed the CBC.

“The government has a long-standing policy of diversifying its portfolio by selling physical commodities (such as gold) and instead investing in financial assets that are easily tradable and that have deep markets of buyers and sellers,” he stated in an e-mail.

That seems to be at odds with the policies of other countries. The World Gold Council attributes the metal’s attraction to other central banks to the “size and diversity of gold supply and demand,” which means it’s “highly liquid and remains so throughout periods of uncertainty. Gold’s historic lack of correlation with other reserve assets and negative correlation to the U.S. dollar mean it is commonly used to manage market risk and improve portfolio performance.”

Central bank buying “surged” in H2 2015, according to WGC figures released February 11, “resulting in the second-highest annual demand in our records.”

With Canada apparently among the exceptions, central banks have been net buyers of gold since 2010, “driven in part by uncertainty over the future of the international monetary systems and the need to diversify reserves,” the WGC stated.

But the CBC found, “Our gold holdings amount to less than 0.1% of the US$82.6 billion that Canada has in official international reserves.” The world’s largest officially reported hoard belongs to the U.S., with its 8,133.5 tonnes making up 72% of total American reserves in 2015, according to the WGC. Following the U.S. is Germany (3,381 tonnes, or 66% of reserves), Italy (2,451.8 tonnes or 64%) and France (2,435.6 tonnes or 60%). To consider a country more comparable with Canada, Australia reported 79.9 tonnes, or 6% of reserves.

Among those selling gold last year, the WGC noted Germany (3.2 tonnes), El Salvador (5.4 tonnes) and Colombia (6.9 tonnes).

Canada held more than 1,000 tonnes of gold during the 1960s, the CBC stated.

-

Goldman Sachs Says Gold’s Bullish Momentum Remains Even If The Fed Maintains Restrictive Rates By

Mint State Gold

May 1 2024