Global Silver Deficit To Rise In 2024 Due To Higher Demand, Lower Supply

THANK YOU FOR POSTING A REVIEW!

Your review was sent successfully and is now waiting for our staff to publish it.

(April 17, 2024 - Polina Devitt, Reuters News)

- Silver faces the 4th year of a structural market deficit

- Visible stocks equal to 15 months of global supply as of end-2023

- Industrial demand hit a record high in 2023, to rise by 9% in 2024

- Silver prices touched highest in the more than 3 years last week

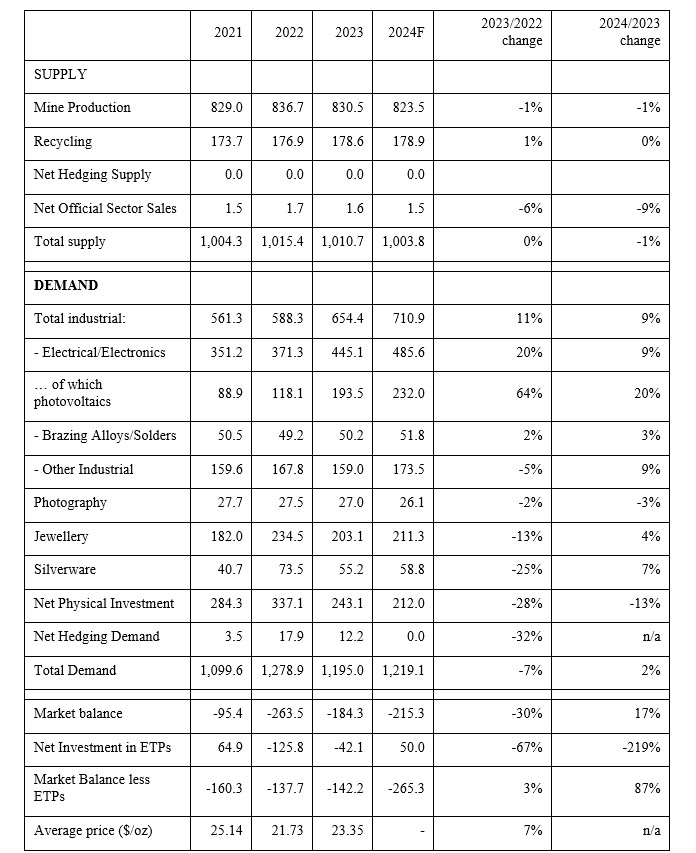

LONDON, April 17 (Reuters) - The global silver deficit is expected to rise by 17% to 215.3 million troy ounces in 2024 due to a 2% growth in demand led by a robust industrial consumption and a 1% fall in total supply, the Silver Institute industry association said on Wednesday.

Silver, which is used in jewelry, electronics, electric vehicles and solar panels, as well as an investment, faces the fourth year of a structural market deficit.

"The deficit in the silver market helps to provide robust support and a strong floor for the price," said Philip Newman, managing director at consultancy Metals Focus, which produced the World Silver Survey for the Silver Institute.

"The deficit fell by 30% last year, but in absolute terms - at 184.3 million ounces - it was still eye-watering. Global supply has been broadly steady at around the 1-billion-ounce mark, while industrial demand did incredibly well with 11% growth."

Despite the shortage, visible silver inventories, as well as vast metal stocks held by individuals and investors, continue to protect the silver market from a squeeze for now.

"Identifiable silver inventories, as well as metal held off exchange, remain sizable. However, some of this silver may be tightly held, so it will be interesting to see, going forward, what impact ongoing deficits have on the market," Newman added.

Stocks held in commodity exchange depositories and London vaults fell by 5% last year and amounted to nearly 15 months of global supply as of end-2023, the report said.

The bulk of the drop in reported stocks took place in China, which historically was a surplus market due to silver production from imported base metals concentrates. "However, the breakneck rise in local industrial demand (of 44%) is changing the local supply/demand and inventory dynamics," the report said.

Spot silver prices up 18% so far this year, touched $29.79 per ounce, their highest in the more than three years, last week amid a gold rally and strong copper prices.

SILVER SUPPLY & DEMAND* (million troy ounces)

*Source: Metals Focus for the Silver Institute