Gold Futures Soar To Historic Highs

THANK YOU FOR POSTING A REVIEW!

Your review was sent successfully and is now waiting for our staff to publish it.

Eyes on Inflation, GDP Data for Next Move

(March 28, 2023 - Damian Nowiszewski, Investing.com)

- Central Banks had a big impact on gold and silver last week.

- Gold futures have made new highs - and traders should watch out for a potential correction because of PCE, GDP data.

- Meanwhile, silver prices are holding steady near a key resistance level.

- In 2024, invest like the big funds from the comfort of your home with our AI-powered ProPicks stock selection tool.

On Thursday, gold futures soared to record levels, with the June contract breaking through the $2,200 per ounce mark and reaching an astonishing $2,233 per ounce at the time of publishing this article.

Currently, there's a 62% probability of the first interest rate cut happening in June.

If the pivot is postponed to the third quarter or the number of cuts is reduced to two or one instead of the expected three, it will trigger a correction in both silver and gold prices.

Gold, in particular, is vulnerable to a pullback toward key support levels after its steady rise.

Next up, after the dust settles from the Fed meeting, the market will shift its focus to upcoming macroeconomic data.

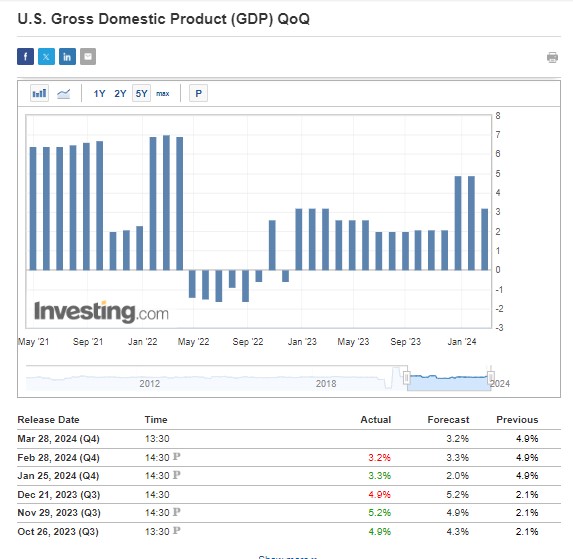

Today, we await the release of GDP growth figures from the US. If these figures confirm the initial estimates, we can expect a significant decline compared to recent quarters.

US GDP

US GDPThere are still no clear indications of a recession in the US economy. The basic scenario therefore remains a soft landing, which should be welcomed by Federal Reserve officials.

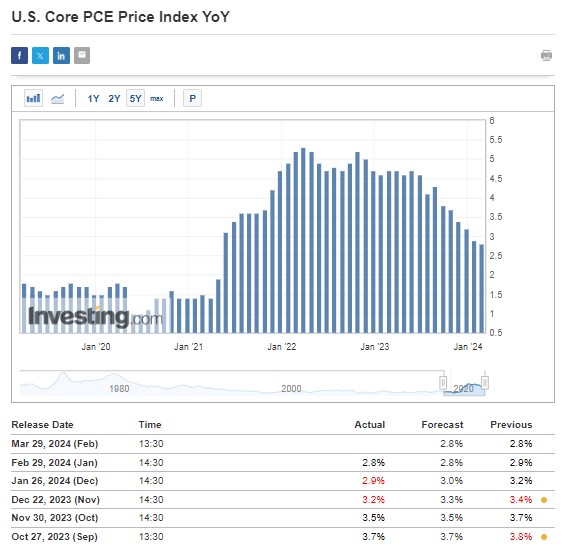

On Friday, the most important reading will be the Fed's preferred measure, the PCE inflation.

The current market consensus confirms disinflation slowing at 2.8% y/y, which corresponds with the stagnation of the headline consumer inflation index.

Core PCE YoY

Core PCE YoYThe final readings, if in line with forecasts, could give the Fed space to postpone interest rate cuts.

Gold Technical View

Gold prices, despite two minor corrections, continue to rise and are on track toward historical highs. However, the direction may change depending on upcoming US data.

If PCE inflation and GDP data show an increase, sellers might gain temporary control.

Gold 5-Hour Chart

Gold 5-Hour ChartIf this happens, sellers will likely target the support level around $2150 per ounce, which has been tested before.

In the longer term, deeper corrections to around $2100 per ounce could offer good buying opportunities at lower prices.

-

Silver Remains On The Defensive Below $27.50 On Easing Middle East Tensions By

Mint State Gold

April 24 2024