Is now the time to add gold in multi-asset funds?

(8/18/22 - Jean-Baptiste Andrieux)

Gold is often seen as an inflation hedge and has historically protected purchasing power over inflationary periods.

Besides, the precious metal also has a low correlation with stocks, which increases its attraction from a diversification standpoint.

Therefore, has the time come to add gold allocation in multi-asset strategies?

Not yet, warns Royal London Asset Management head of multi-asset Trevor Greetham.

He says investing in commodities, including gold, has been beneficial in the inflationary post-Covid recovery. This was especially the case when compared with a typical balanced fund investing only in stocks and bonds.

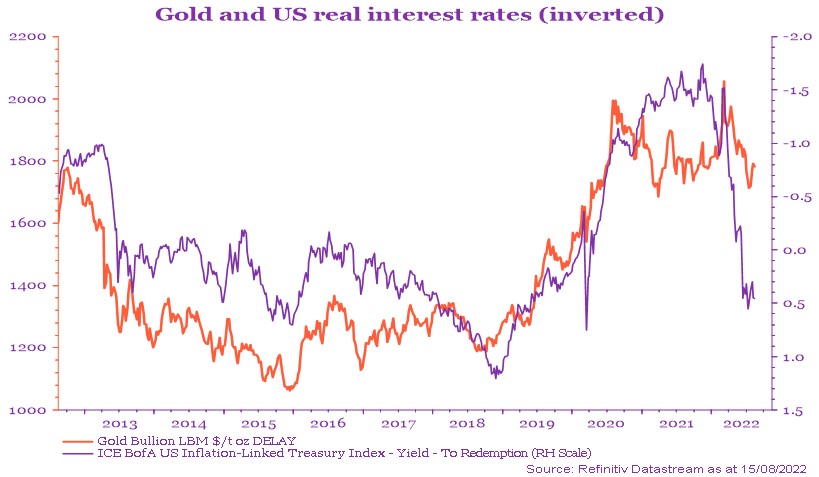

“However, gold isn’t always a good inflation hedge in real time because it tends to fall in price when the dollar is strong or when real interest rates are rising, and we’ve seen both happen in recent months,” he adds.

In addition, gold prices were down this year in US dollar terms, despite the surge in inflation and a strong performance from energy, industrial and agricultural commodities.

Gold has lagged broad commodity index this year

Source: Bloomberg

Greetham says: “While US headline inflation looks to have peaked, due to a combination of recent falls in energy prices, some easing of supply chain disruptions and weaker global growth, it is premature to expect a pause in tightening from the Fed with wage growth still running at uncomfortably high levels. Real rates may not fall materially just yet.

“Moreover, the economic outlook outside of the US looks worse due to the continuing energy crisis in Europe and the UK and China’s zero-covid policy, so the US dollar may not weaken substantially in a global slowdown.

“Both points suggest it may be early to be adding to gold at the moment but we are keeping the situation under close review.

“As and when the US economy slows enough to flip the Fed from rate hikes to rate cuts, gold could come into its own, especially relative to stocks, which are likely to suffer a second leg of bear market as corporate earnings contract.”

On the other hand, Rathbone lead fund manager of multi-asset portfolios David Coombs tells Money Marketing he is switching into gold again.

He says: “In my view, the Fed is getting close to peak rates. That will probably mean that we are getting close to peak dollar strength. If that’s the case, that could be quite supportive of gold.

“Gold is often the last safe haven. Given the tension in the Taiwan Straits, the continued situation in eastern Europe, energy shortages in many countries, I think having gold in a portfolio is a good diversifier.

“It’s not an asset I particularly like holding, because it has no income, so it’s very hard to value, but the world looks more troubled than it did five or 10 years ago.

“Having taken my gold down a couple of years ago, it is probably time to sort of rebuild those positions.”

Gold and US real interest rates

Fulcrum Asset Management deputy chief investment officer Nabeel Abdoula says that investors might want to look beyond traditional asset classes in the current market environment.

“There’s no doubt that investors are experiencing a more risky market environment in more traditional asset classes (i.e. equities and bonds), and sensing that, it’s no surprise that commodities, illiquid alternatives and gold are in favour as investors look to mitigate the current conditions,” he said.

Recent research by international investment consultant Asset Risk Consultants found that 14 out of 16 asset classes have suffered losses in the first six months of 2022. Commodities and gold were the only exception.

Moreover, Natixis Investment Managers found in a survey published in June that financial advisers are increasingly seeing commodities as appealing in an inflationary investment.

In fact, 73% of European advisers and 61% of their British colleagues shared this opinion.