Silver Is At A Critical Vertex - CMP Group Issues Silver Buy Call

THANK YOU FOR POSTING A REVIEW!

Your review was sent successfully and is now waiting for our staff to publish it.

(December 3, 2019 - Anna Golubova | Kitco)

The silver market looks ready to make gains in the next several years, which is why CPM Group has issued an intermediate-term silver buy recommendation to investors.

“The silver market is at a critical vertex at present,” CPM Group’s vice president in charge of research Rohit Savant said on Monday.

Silver prices are more likely to rise than fall in the next few years, but uber bulls might still be disappointed, noted CPM.

“Silver market fundamentals are precariously similar to the critically poor conditions that existed in 1989. Our expectations are that the market may avoid the long period of net investor silver selling and low prices that followed from that year,” Savant said. “Prices seem more likely to rise in the years ahead rather than to decline. There are many external as well as internal factors behind our analysis. That said, super bulls will continue to be disappointed by silver.”

CPM defined its intermediate timeline as between two and three years.

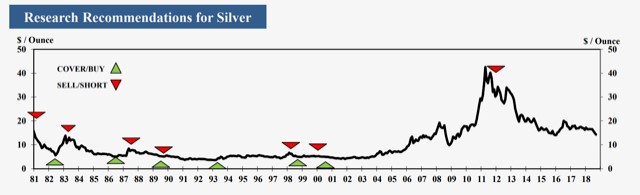

This call has been long in the making. The last time CPM issued a recommendation on silver was back in May 2011 when prices reached $48.19 and CPM advised to sell.

“CPM has waited until now for a variety of reasons known to our clients. For one, the market has not supported strongly higher prices over the past few years. As a result, prices have not moved sharply off their 2015-2016 lows,” CPM managing partner Jeffrey Christian said.

Since the end of 1980, CPM’s recommendations have been to short silver 53% of the time, and to be long silver 47% of the time.

“The theoretical return from following CPM’s buy and sell recommendations would have been … an 18.9% compounded return. This compares to a 5.5% increase or 0.14% annual return for silver bought and held during the same period,” the group said on Monday.

-

Goldman Sachs Says Gold’s Bullish Momentum Remains Even If The Fed Maintains Restrictive Rates By

Mint State Gold

May 1 2024