Silver – The Most Incredible Trade Setup of Your Lifetime

(June 4, 2019 - Neils Christensen)

Our research team believes Silver could be the Sleeper Rally setup of a lifetime for investors if the global economic cards continue to get scattered and crumpled over the next 10+ years.

Our research team is going to share with you some incredible insights into what may become the most incredible trade setup we’ve seen in the past 12+ years – the Sleeper Silver Setup.

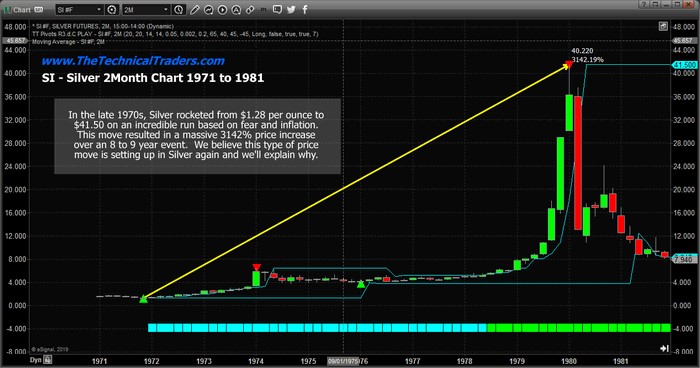

Going all the way back to the early 1970s, when the Hunt Brothers ran most of the metals markets, we can see the incredible price rally in Silver from $1.28 per ounce to nearly $41.50 in late 1979. This move setup with a very simple pattern – a high price breakout in 1973 that broke a sideways price channel and initiated a nearly 6+ year rally resulting in an incredible 3142% price increase from the lows.

Could it happen again?

Well, after this incredible price peak, the price of Silver languished and moved lower, eventually bottoming in 1991 near $3.50. After that bottom setup, the price of Silver setup another sideways price channel and traded within this range until a 2004 High Price Breakout happened AGAIN. It seemed inconsequential at the time – a rogue high price near $8.50. Maybe that was it and maybe price would just rotate lower back to near the $4.00 range??

This High Price Breakout setup an incredible price rally that resulted in a continue price advance over the same 6+ year span of time. This rally was not as big as the 1974 to 1979 price rally in percentage terms, but it was much bigger in terms of price valuation. The 1979 price peak ended at $41.50 and resulted in a $40.25 price increase whereas the 2011 price peak resulted in a $46.32 price increase.

Will it happen again in our lifetime?

As incredible as it might seem, we believe Silver is setting up another High Price Breakout pattern that should conclude within the next 2 to 4 months with a price high near $22.50 to $24.00 (see our proprietary Fibonacci price modeling projections below). After this peak is reached, hold on to your hat because we believe the upside price rally could mimic past rallies and attempt to immediately move the price of Silver to well above $85 per ounce. Ultimately, we can only guess as to where the top of this move may end – but we can safely estimate it will likely top somewhere between $90 and $550. This, of course, will require some type of major bear market in other asset classes and possibly some global crisis but we believe it is very possible in due time. Our predictive modeling systems will help us determine where the actual price peak will be as this unfolds over time.

And there you have it – one of the most incredible trade setups you’ll ever see in your lifetime. Yes, it may happen twice in your life or more, but we believe this setup in Silver is just weeks or months from initiating the next upside price leg (the High Price Breakout) and we are alerting you now to be prepared. – Chris Vermeulen

Silver Testing 20-Year Support – Its Bear Market Is About to End

Silver has lost nearly two-thirds of its value in the past 8-years. Is the bear market in Silver about to end? What Silver does at (2) will go a long way to answering this question!

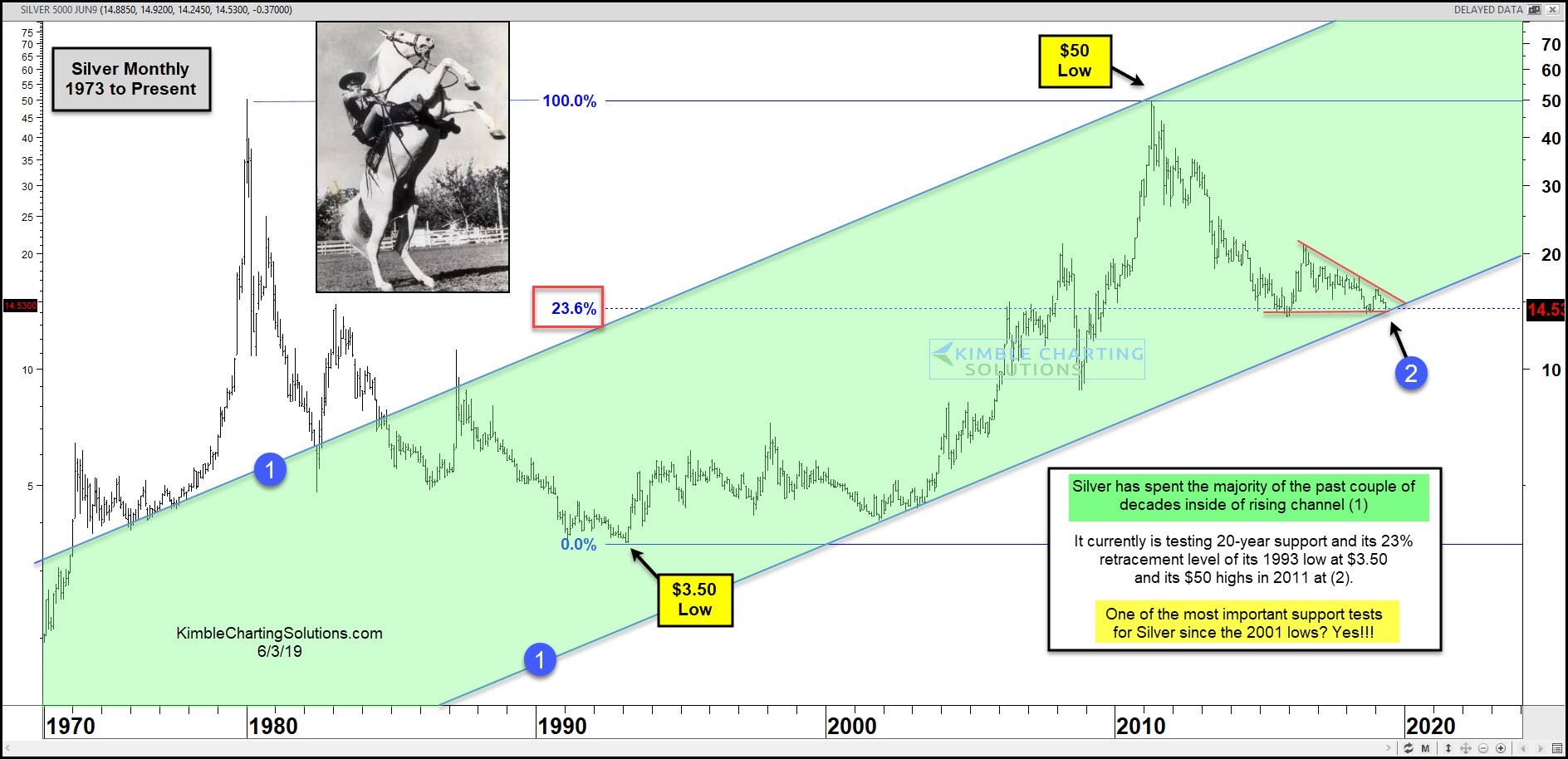

Silver has spent the majority of the past couple of decades inside of rising channel (1). It hit the top of this channel and its 1980 highs in 2011, where a major peak took place.

The 8-year decline in Silver has it currently testing the bottom of this channel and its 23% Fibonacci retracement level at (2).

Silver looks to be creating a descending triangle over the past few years. This pattern looks to be nearing completion, which suggests a large move in Silver is near.

In my humble opinion, Silver is facing one of its most important support tests in the past few decades. This is a MUST hold price point for hard-hit Silver.

Is it Hi-Yo Silver time for Silver? If Silver holds at support and breaks above falling resistance, look for a quality rally to take place. – Chris Kimble

It’s Time for Silver Prices to Play Catch-Up With Gold

All eyes are on the gold market after prices pushed to a two-week high at the start of the week, but some market analysts say that the precious metal to watch is silver.

Silver has been a constant disappointment to investors this year; the metal has significantly underperformed within the precious metal sector as the gold to silver ratio trades near a 26-year high. However, some analysts have said that with gold on the move, it could be time for silver to shine.

Both gold and silver futures are trading relatively unchanged on the day, ahead of the North American equity open. July silver futures last traded at $14.74 an ounce and August gold futures last traded at $1,328.30 an ounce.

In a recent interview with Kitco News, Bill Baruch, president of Blue Line Futures, said that he is watching silver closely to see if the rally in gold can transform into a sustainable bull market. He added that silver’s recent bounce off from six-month lows is breathing new life into the precious metal.

“I think there is some real potential for silver,” he said. “Silver needs to join this party to bring staying power gold’s rally.”

Ole Hansen, head of commodity strategy at Saxo Bank, said that there are good reasons why silver has suffered more than gold. He explained that growing global recession fears have weighed on silver’s industrial demand, which takes up roughly half of silver’s supply.

“During the February-to-May sell-off, silver dropped twice as much as gold and only during the past couple of days has it shown signs of life after breaking the downtrend from the February high,” he said.

Hansen explained that because of the current market environment, speculative fund managers have been actively selling the metal. The latest trade data from the Commodities Futures Trading Commission shows that the precious metal’s speculative net-short positioning is at its highest level since November.

However, Hansen said that the sell-off is overdone and that short sellers are unprepared for higher prices in silver.

“A continued gold rally from here could on that basis attract short covering in silver, which may trigger an outperformance despite the mentioned headwinds,” he said.

Looking at the gold market, Hansen said that prices could consolidate above $1,300 an ounce, but if the market can hold support at $1,316, he sees the possibility of prices retesting the February’s highs around $1,350 an ounce.

Helping to support the yellow metal is the growing market pressure for the Federal Reserve to cut interest rates. The CME FedWatch Tool is now pricing in three rate cuts by the end of the year.

“With the FOMC moving towards a cutting mode, recession risks on the rise and a trade deal still nowhere near to being agreed, this is the time for gold to show what metal it is made of,” he said.