The Worst Performing Precious Metal, Silver, May Have Bottomed Out

THANK YOU FOR POSTING A REVIEW!

Your review was sent successfully and is now waiting for our staff to publish it.

( 8/8/22 - Victoria Fetcher)

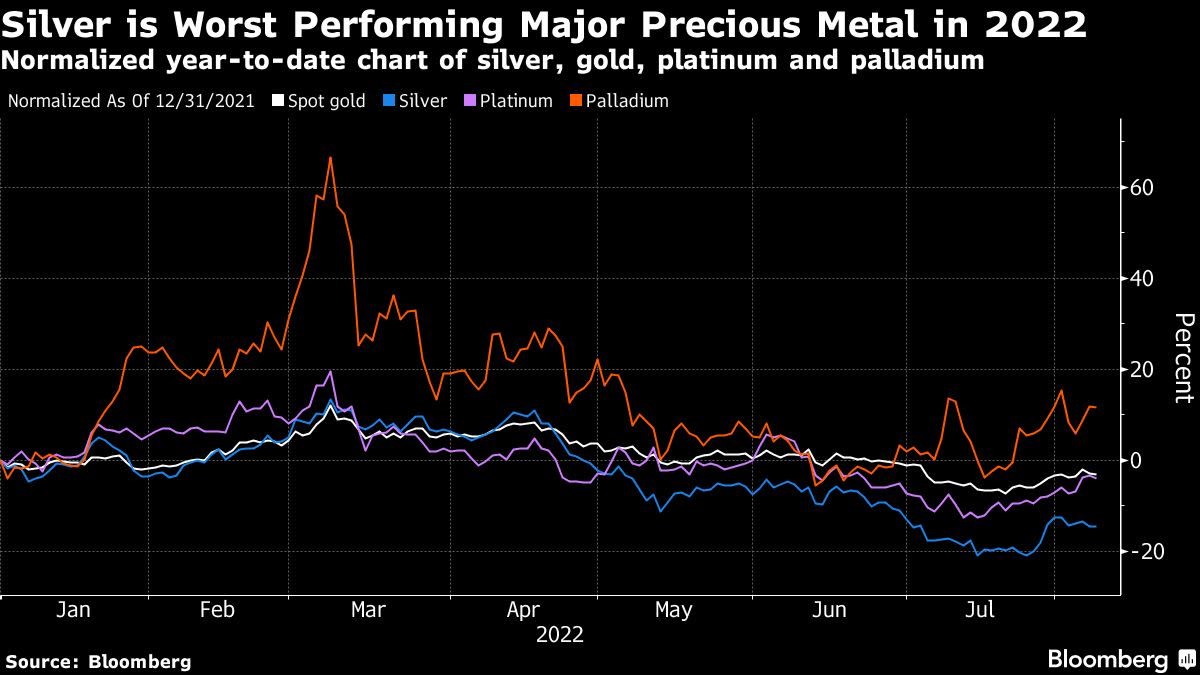

(Bloomberg) – Silver has been the worst-performing major precious metal in 2022, but prices may have fallen enough to trigger a modest recovery.

The white metal is down about 11%, weighed down by a stronger US dollar, rising interest rates and slowing growth. But prices could rise from the end of this year as the electronics and photovoltaic sectors support industrial consumption, while retail and jewelry demand looks strong, James Steel, chief precious metals analyst at HSBC Securities USA Inc., said earlier this month a message.

“We think silver is oversold,” Steel said. “Much of silver’s industrial demand will be well supported and will not reflect overall industrial inertia,” while price declines will boost demand from key consumers China and India, he said.

Still, there are headwinds for the white metal’s rally as the world braces for a stimulus rollback and an economic slowdown.While HSBC remains positive, it has lowered its forecast as silver follows gold and copper lower. The bank now sees the average price for 2022 at $22.25 per

ounce and for 2023 at $23.50 per ounce. UBS Group AG expects silver to trade lower to $19 by early 2023.

Silver was trading at $20.67 an ounce in Shanghai as of 8:37 am after recovering from a two-year low in mid-July.

Silver’s price will follow gold’s closely, and investors should consider buying both metals when the Fed makes an appropriate dovish turn and there is significant policy easing to support growth, said Wayne Gordon, executive director for commodities and FX at UBS Group’s global wealth management unit.

“Once we get that stage of recovery in gold, we believe silver can really outperform the yellow metal,” Gordon said.

Gold was little changed at $1,789.42 an ounce with the dollar holding steady as traders await a key US consumer inflation report on Wednesday. Palladium fell and platinum rose slightly.