Twenty Years Of The Central Bank Gold Agreement Comes To An End Today

THANK YOU FOR POSTING A REVIEW!

Your review was sent successfully and is now waiting for our staff to publish it.

(September 27, 2019 - John Reade of WGC)

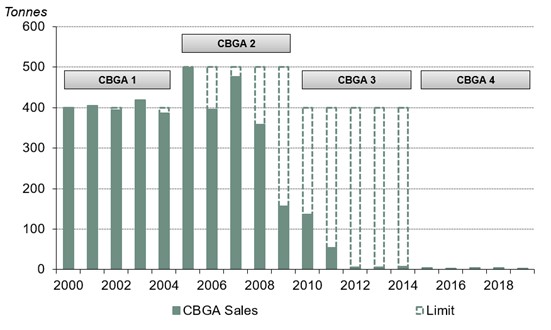

Today marks the end of the final Central Bank Gold Agreement (CBGA). Over the last twenty years, the agreement has helped stabilize the gold market by limiting the amount of gold that signatories, all European central banks, could collectively sell in any one year.

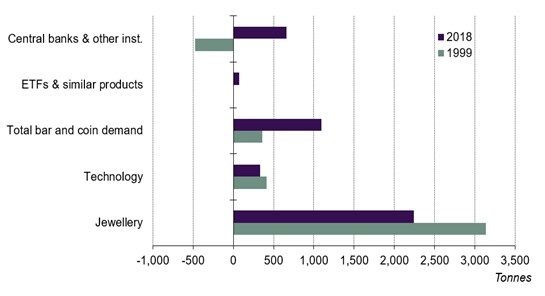

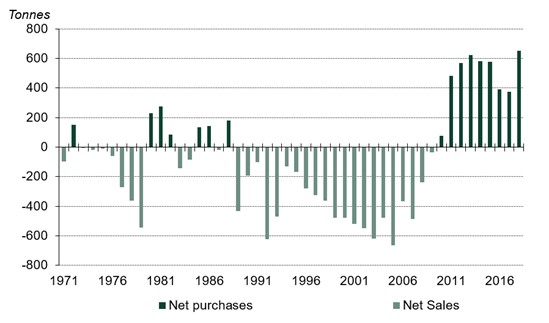

But the gold market has changed drastically over the last two decades. Sources of demand are more diverse than they were in 1999, and the price is significantly higher. Central banks were (uncoordinated) net sellers at the time, prompting the CBGA.

Central banks’ behavior with respect to gold fundamentally shifted following the global financial crisis in 2009. Since 2010, they have been net purchasers on an annual basis – averaging 485t per year between 2010-2018.

In fact, 2018 saw the highest level of annual net purchases since the suspension of dollar convertibility into gold in 1971, and the second highest annual total on record.

Central bank demand remains strong in 2019, and the gold market more balanced than twenty years ago. Accordingly, the signatories felt that a formal agreement to regulate sales was no longer necessary. This is a significant endorsement of the current state of the gold market.

While the CBGA may be no more, the signatories did, however, confirm that: “Gold remains an important element of monetary reserves”

-

Goldman Sachs Says Gold’s Bullish Momentum Remains Even If The Fed Maintains Restrictive Rates By

Mint State Gold

May 1 2024