Unstoppable Palladium Flirts With $2,000 For First Time

THANK YOU FOR POSTING A REVIEW!

Your review was sent successfully and is now waiting for our staff to publish it.

(December 18, 2019 - Peter Hobson)

LONDON (Reuters) - Palladium prices are within a whisker of breaking above $2,000 an ounce for the first time, with a gaping supply deficit fueling a remarkable run that has seen the auto catalyst metal more than quadruple in value since 2016.

Ingots of 99.97 percent pure palladium are stored at a plant owned by Krastsvetmet, one of the world's biggest manufacturers of non-ferrous metals, in Krasnoyarsk, Russia April 9, 2019. REUTERS/Ilya Naymushin/Files

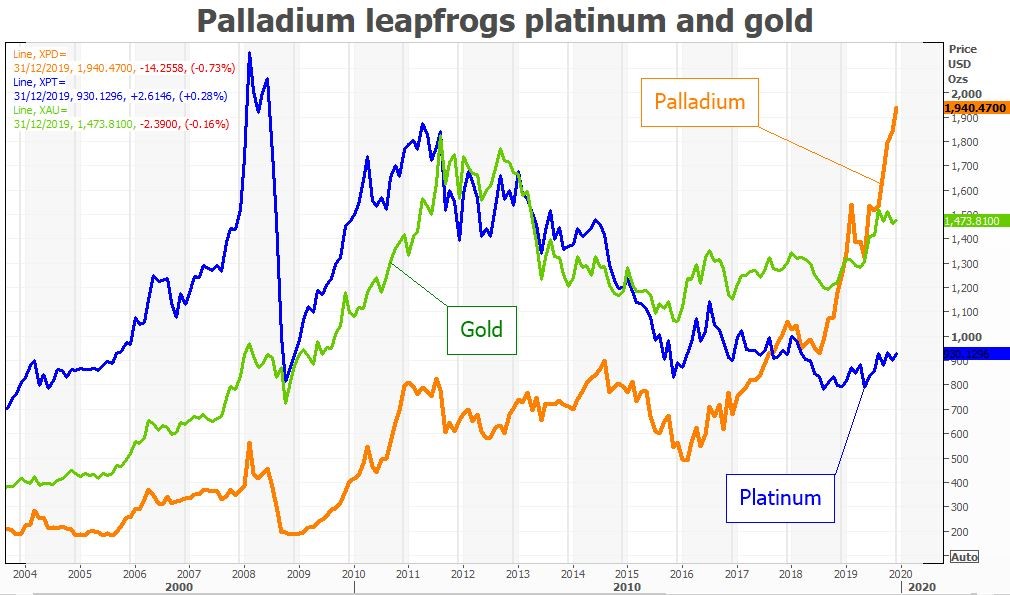

Once the cheapest of the major precious metals, palladium, used chiefly in engine exhausts to reduce harmful emissions, is now more than twice as expensive as platinum and $500 an ounce more than gold.

Prices have surged almost 60% this year, reaching $1,998.43 an ounce on Tuesday, before slipping back to around $1,950. In January 2016, an ounce cost as little as $449.55.

Palladium prices vs platinum and gold here

Tighter environmental legislation is forcing auto makers, who consume more than 80% of palladium production, to use more metal per vehicle — boosting demand even as the global economy and overall vehicle sales slow.

Adding to momentum were worsening power outages in major producer South Africa this month, which disrupted mining activity.

“We don’t think this is the top,” said Philip Newman at consultancy Metals Focus. “This (rally) has legs to run, because it is fundamentally driven,” he said.

Prices may pull back briefly, but auto makers have pushed prices higher again and again this year, said Mitsubishi analyst Jonathan Butler,

“Any dip represents a buying opportunity (for them),” he said.

Citi analysts expect palladium to rise to $2,500 by the middle of 2020.

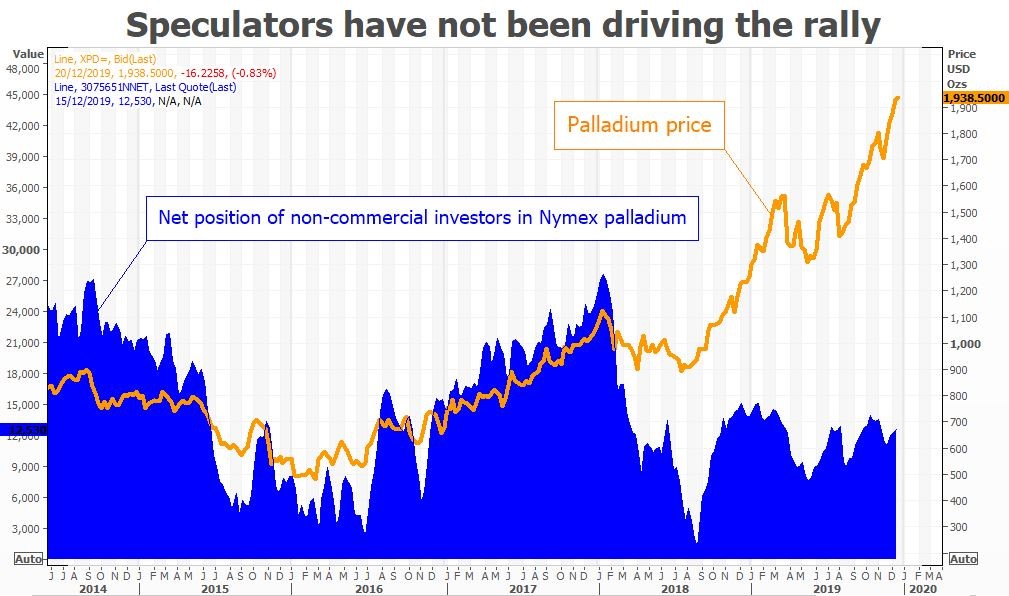

Palladium positioning here

Metals Focus predicts demand from the auto sector will rise by around 200,000 ounces this year. That would push the deficit in the roughly 10-million ounce a year palladium market to some 430,000 ounces — the eighth consecutive annual shortfall — and more deficits will follow, it says.

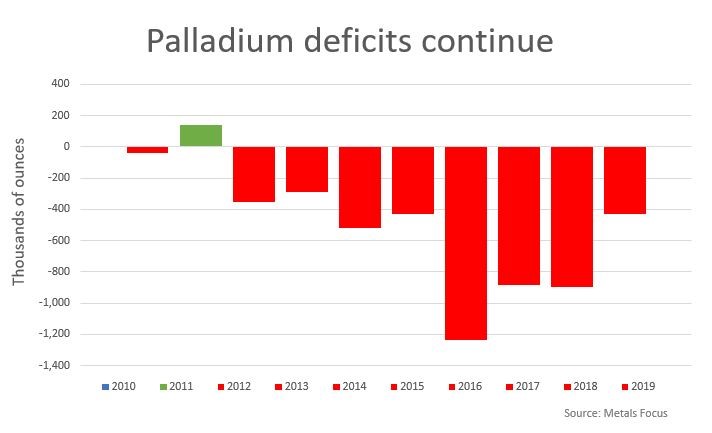

Palladium deficits here

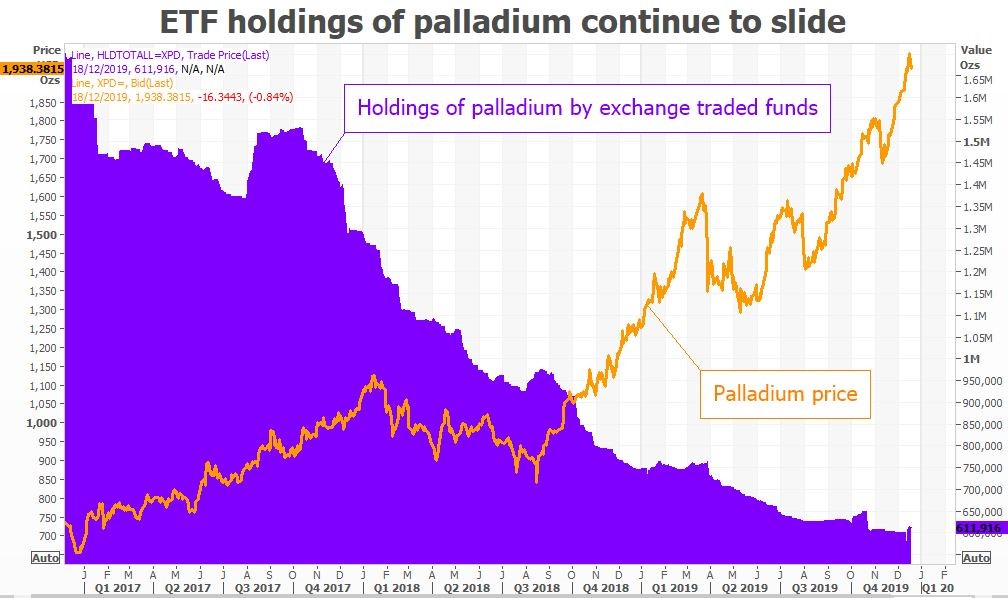

Above-ground stocks are expected to fall below 13 million ounces from around 18 million ounces at the end of 2010, according to Metals Focus. Holdings of palladium in exchange traded funds (ETFs) — which have helped to fill the shortfall — have continued to fall.

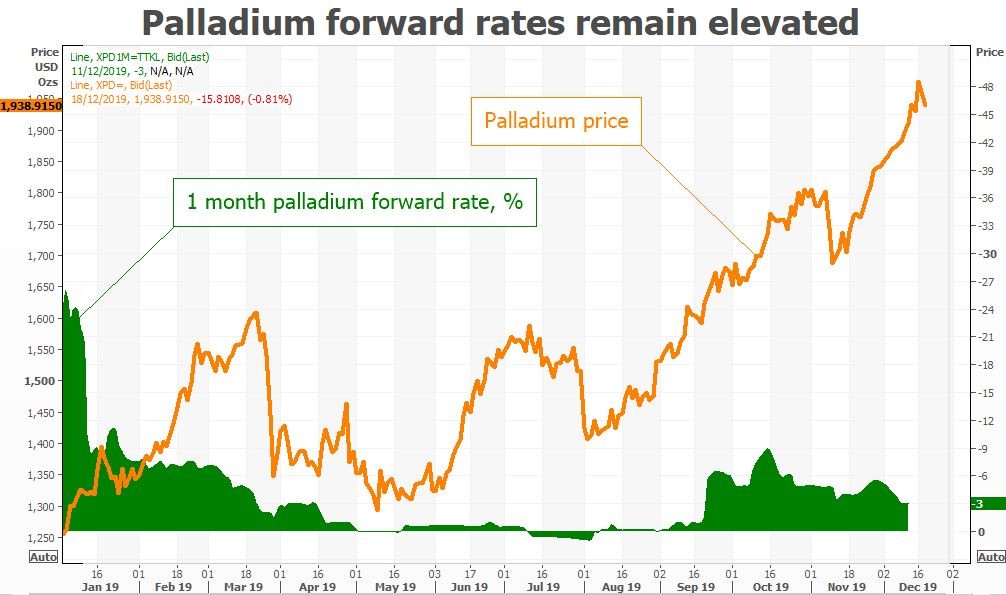

However, forward and lease rates have slipped below 5% from near 10% in October, suggesting the market has not tightened in recent months.

Palladium forward rates here

Fears that the auto industry will replace palladium with platinum to save money — something many predicted would puncture the rally — have shown no sign of being borne out.

But many analysts expect that to slowly change and prices to move back toward $1,000 an ounce around the mid-2020s.

“Ultimately, high prices kill high prices,” said Macquarie analyst Marcus Garvey, predicting slightly higher supply and some auto sector substitution would help create a small surplus by 2023.

-

Silver Remains On The Defensive Below $27.50 On Easing Middle East Tensions By

Mint State Gold

April 24 2024