What Silver Buyers Should Know Before Buying Physical Silver

(July 28th 2022-Barry Stuppler)

With the Silver price under $20 per ounce, it is truly the investment of the century.

The Silver-to-Gold Ratio is currently over 90-to-1, anything over 60-to-1 is an extraordinary value.

What are your primary choices when buying popular physical bullion silver?

- American .999 1oz Silver Eagles

- Canadian .9999 1oz Silver Maple Leafs

- .999 Silver 1oz Buffalo Trade Units

- 90% Circulated Silver U.S. Pre-1965 Silver Dimes, Quarters and Half Dollars

- 100 oz .999 Silver Bars

Right now, the key factors for silver investors to look at before buying are:

PREMIUM and SPREAD

Premium – Is the price over the spot Silver value that has changed dramatically higher in the past year. The increase in demand and the shortages of physical product have driven up premiums on many of the popular Silver investment items. Dealer premiums can change daily, based upon the dealer’s inventory levels and size of the sale or purchase.

Spread - Is the difference between the bid/ask prices dealers buy and sell for.

The more popular the Silver product is, normally the tighter the spread. Why is the spread important? You need to overcome the spread before making a profit.

Remember both premiums and dealer spreads are based on U.S. Dollars and change daily. Both also can tighten based on the quantity of the purchase.

The following five Silver items are in order of least favorite to my best choice:

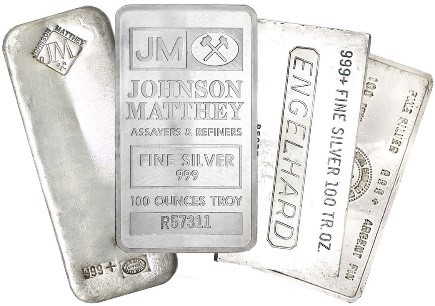

100 oz .999 Silver Bars

Most newcomers to Silver investing normally start by asking about Silver bars.

They may have the lowest premium but have many problems. Most dealers are concerned about authenticity of Silver bars (many counterfeit bars have come from China). For that reason, many dealers don’t pay much when you sell a 100-ounce Silver bars nor hold that much in inventory of them as most get melted. Also, dealers that are willing to buy them, insist on having the bars assayed before buying. If you want bars, insist on 100-ounce Engelhard, Johnson Matthey or Royal Canadian Mint (RCM), with numbers and certification, and keep your bill of sale. The dealer bid/ask spread is wide because of low popularity.

Recommendation – Avoid if you are making purchases under $500,000.

If you are a large Silver investor (over $500,000), I suggest 1,000 ounce .999 bars certified and stored/insured at a licensed COMEX depository.

90% U.S. Pre-1965 Silver Dimes, Quarters or Half Dollars.

Bags of $100 face value normally run about $2,000. Considering the bag contents, 71 ½ ounces of pure Silver, that’s $28 per ounce, or $8 over the spot price for 90% junk Silver coins. Also, history has shown us the premium on 90% U.S. coins drops as the price of silver moves higher. The dealer bid/ask spread is wide because of low popularity.

Recommendation – Avoid purchasing and sell/trade them at the current high premium immediately for our #1 selection below

American .999 1oz Silver Eagles

One of the most popular Silver bullion products with investors, causing the premium to be driven up to $13 per ounce over spot. You could have purchased Silver eagles for $5 over spot in 2021. When supply issues are handled by many of the world’s leading mints, they will be back up to full capacity and premiums will definitely drop.

Recommendation - If you wish to purchase U.S. Silver Eagles, I recommend buying them in original mint tubes of 20. Minimum 100 coins or more as the spread is $4 per ounce.

Canadian .9999 Silver 1oz Maple Leaf

A very popular government minted silver bullion coin. Four 9’s fine and minted in excellent quantities for investors. The premium is half that of the American Silver Eagles around $6.50 over the spot price. In lots of 100 coins or more, the spread is only $2.50.

Recommendation – Good item. Premium is half that of the American Silver Eagles. In lots of 100 coins are more the spread is around $1-2 better then American Silver Eagles.

CANADIAN RESIDENTS:

Make this your first choice, because of the popularity in Canada. Just convert the premium and spread into Canadian Dollars

100 oz .999 Silver Bars

Most newcomers to Silver investing normally start by asking about Silver bars.

They may have the lowest premium but have many problems. Most dealers are concerned about authenticity of Silver bars (many counterfeit bars have come from China). For that reason, many dealers don’t pay much when you sell a 100-ounce Silver bars nor hold that much in inventory of them as most get melted. Also, dealers that are willing to buy them, insist on having the bars assayed before buying. If you want bars, insist on 100-ounce Engelhard, Johnson Matthey or Royal Canadian Mint (RCM), with numbers and certification, and keep your bill of sale. The dealer bid/ask spread is wide because of low popularity.

Recommendation – Avoid if you are making purchases under $500,000.

If you are a large Silver investor (over $500,000), I suggest 1,000 ounce .999 bars certified and stored/insured at a licensed COMEX depository.

90% U.S. Pre-1965 Silver Dimes, Quarters or Half Dollars.

Bags of $100 face value normally run about $2,000. Considering the bag contents, 71 ½ ounces of pure Silver, that’s $28 per ounce, or $8 over the spot price for 90% junk Silver coins. Also, history has shown us the premium on 90% U.S. coins drops as the price of Silver moves higher. The dealer bid/ask spread is wide because of low popularity.

Recommendation – Avoid purchasing and sell/trade them at the current high premium immediately for our #1 selection below

.999 Silver 1oz Buffalo Trade Units

The most popular Silver bullion investment coin currently being offered. The premium is fairly low, around $4.50-$6 over the spot Silver price, and the spread is the tightest of all the popular Silver Bullion Items.

These actively trade in boxes of 500 with dealers and investors. A number of private mint issue 1oz Silver Trade, (i.e. Golden State, Sunshine, SilverTowne).

The buffalo design is by far the most popular

Recommendation – BEST AND TOP CHOICE FOR SILVER BULLION INVESTORS (UNDER $500,000). As it has the tightest spreads and lowest premium.

JUST MAKE SURE YOU PURCHASE THE BUFFALO DESIGN (PHOTOGRAPHED ABOVE). MANY OTHER PRIVATE MINT DESIGNS HAVE HUGE PITFALLS!

One major issue to consider when buying precious metals is SALES TAX.

26 states have some form of sales tax exemptions. However, eBay and Amazon charge sales tax on precious metals. I recommend purchasing directly from an established coin/bullion dealer to avoid paying state sales tax.

Lastly, many Silver/Gold bullion items are counterfeited and sold On-Line, Swap meets and in newspaper ads at bargain prices. Please, only buy precious metals from a creditable Coin/bullion dealership, and please spend the time needed to check them out.

There are many Silver Bullion plus investment coins, but I’ll get to them in my next article

Please email any questions to [email protected]

Barry Stuppler

President MintStateGold.com