Which Metals Will Shine In 2022?

(February 3, 2022 -Baker Steel Capital Managers LLP)

Secular trends and historic cycles support a strong year for metals and mining

At the start of 2022 we consider that there has rarely been a better time for investors to build positions in selected commodities and mining equities. Natural resources lie at the heart of many of the core themes for investors this year and beyond, which include a shifting macroeconomic environment, tense geopolitics, the prospect of economies reopening post-COVID, and the next stages of the green energy revolution which looks set to transform industrial activity.

These themes have significant implications for the undervalued natural resources sector, at a time when change is underway and volatility has resurged across global equity markets, ending the “risk on” environment of 2021 which saw global stock markets hit record highs and speculative investing become rampant. As we begin 2022 we consider that the mining sector is only at the start of a major upcycle, and identify several key themes for investors:

- The new “Green Supercycle” will gather pace and demand projections for certain critical and strategic metals are likely to continue to surge, increasing the risk of shortages and price spikes in the near future.

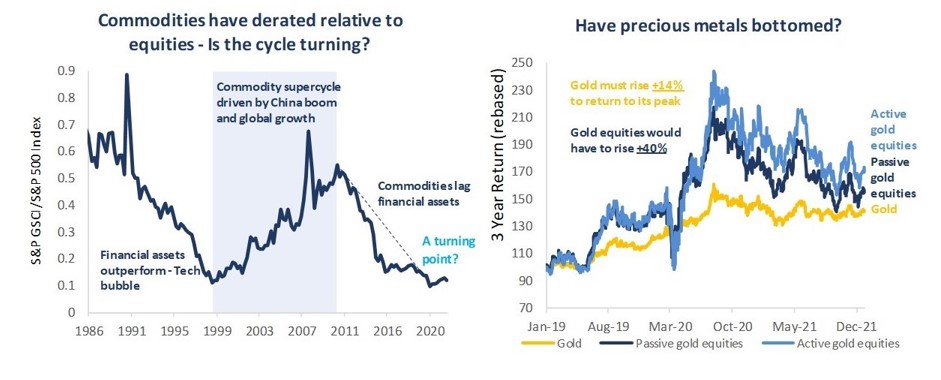

- The interplay between inflation, rates and geopolitics could be a turning point for precious metals in the months ahead and as the rate cycle evolves and the reality of lower real interest rates for longer emerges, 2022 could mark the year that precious metals respond positively.

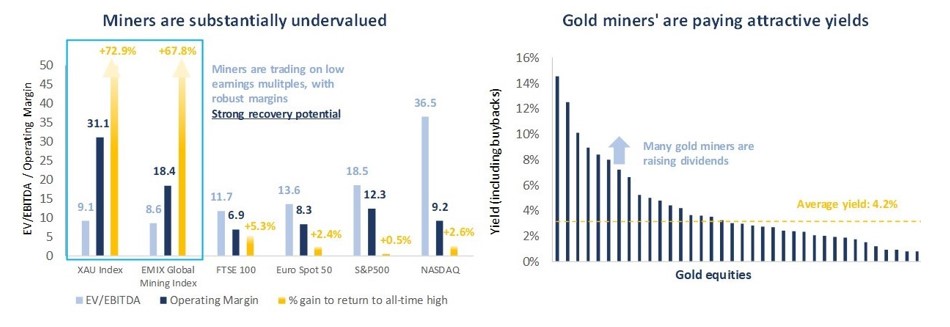

- Mining equities, in particular precious metals, are historically and relatively undervalued despite strong balance sheets, good margins, high dividends and organic growth prospects. The mining sector offers diversification, value and growth.

- There will be significant differentiation between individual producers based on ability to manage cost inflation (in particular higher energy costs), exposure to supply chains, and the differing supply-demand characteristics of individual commodities.

- ESG will continue to become even more important for mining companies and investors.

Source: Bloomberg. Data at 5 January 2022. Data in USD terms. Note, Active Gold Equities are based on BAKERSTEEL Precious Metals Fund, Passive Gold Equities are based on the EMIX Global Mining Gold Index.

Green revolution and the energy crisis: The transformation of the speciality metals sector is underway

- The global fight against climate change – The high cost of achieving net zero is inflationary for commodities as critical metals are needed, supplied in a sustainable and responsible manner.

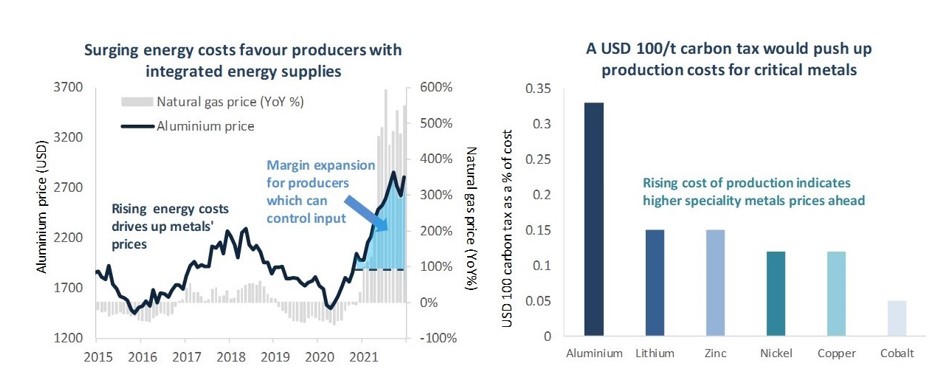

- Energy costs are rising – Companies face rising energy costs, yet producers with dedicated sources can benefit from margin expansion, while selling materials needed for green revolution.

- Supply chains face issues – Supply challenges for speciality metals increases the risk of shortages and price spikes as demand soars.

Among the biggest secular trend for investors globally is the green revolution and the fight against climate change. The transition towards sustainability and decarbonisation impacts virtually all sectors and industries, yet none more so than the mining sector, which supplies the critical raw materials needed to ramp up production of batteries, electric vehicles, wind turbines, electric infrastructure and a multitude of other functions relating to the expansion of green industry. Lofty political goals will often clash with economic reality, yet the progress of the last year indicates that the willpower is there among policymakers, businesses and consumers to drive the move towards sustainability.

The current rapid adoption of electric vehicles (“EV”) exemplifies the speed of change underway. EV sales, including battery and plug-in hybrids, are forecast to have risen +83% during 2021, accounting for 7.2% of global car sales, compared with 2.9% in 2019 and 4% in 2020 (Bloomberg NEF). As many readers may know from personal experience, the industry has now reached a point where if you are buying a car this year you, as a consumer, face a real decision between buying your last internal combustion engine (“ICE”) or buying an EV. The faster than expected increase in EV production was highlighted by record production numbers from Tesla for Q4 2021, and with Ford, GM and other major companies having committed to all new car sales being zero emissions by 2040, production is set to continue to accelerate. Importantly, the growth of EV demand is not only significant for the battery metals, lithium, cobalt and nickel, which are closely associated with the industry, but for a wide range of speciality and industrial metals. EVs use almost three times more copper than internal combustion engine vehicles, alongside gold and silver used in circuitry. Aluminium, magnesium and vanadium are used in the manufacturing of lightweight frames, improving weight reduction. Meanwhile rare earths contribute to the efficiency of EVs, which are three to four times more efficient than ICE vehicles. Of course, EV development is only one aspect of the green revolution, alongside many other industries including clean energy, grid and grid storage, advanced materials, green construction and recycling, all of which utilise speciality metals in some form.

The transition towards clean energy presents a particularly interesting area at present, as consumers and industries face rapidly rising energy prices. The recent energy crises worldwide, which caused oil and gas prices to spike as governments turned to fossil fuels to make up the deficit, highlight the difficulties ahead for policymakers. For mining companies, rising energy costs can be an opportunity. Energy costs make up a sizable portion of total production costs for many speciality metals. Rising energy costs can drive up metals prices; however, margins can also be eroded by rising costs. Producers with fully integrated energy supplies, such as those with renewable sources in close proximity, can benefit from margin expansion, as energy costs rise. Aluminium producers in particular illustrate this opportunity, as energy makes up around 60% of the metal’s cost base.

Source: Bloomberg, Baker Steel Capital Managers LLP. Data as at 31 December 2021. Note, illustrative costs based on fully integrated supplier.

Carbon taxes are an essential policy tool for lowering emissions, and these taxes are likely to rise as the world moves towards decarbonisation. Carbon taxes may have significant cost implications for the production of many critical metals, pushing metals prices higher, with lower carbon producers likely to benefit from margin expansion.

The transition to net zero is the critical challenge for policymakers and investors, with the costs estimated at USD 3-5 trillion (about 3% of global GDP) a year over the coming decades. As the world takes small steps towards achieving this goal, the inadequacies of major economies’ infrastructure and supply chains is becoming starkly apparent. Nowhere are these inadequacies of supply more evident than in the natural resources sector, where the green revolution is exposing some of the shortages of critical commodities. There is a huge need for capital investment in the mining sector. Production must take place sustainably, and financial markets need to consider the timelines for building large scale base metals projects, which can take over 10 years in some cases. Furthermore, the sector faces a range of supply chain issues in the months and years ahead. Alongside shorter-term disruption from the COVID-19 crisis, we are seeing more permanent changes to supply chains, such as “reshoring” by businesses, rising costs, and more worryingly resource nationalism increasing among governments.

Inflation, interest rates and geopolitics present catalysts for precious metals’ overdue recovery

- Inflation is positive for real assets and commodities - Precious metals are the ultimate real financial asset and we believe gold and silver prices will rise significantly during the new era of inflation, once current headwinds abate.

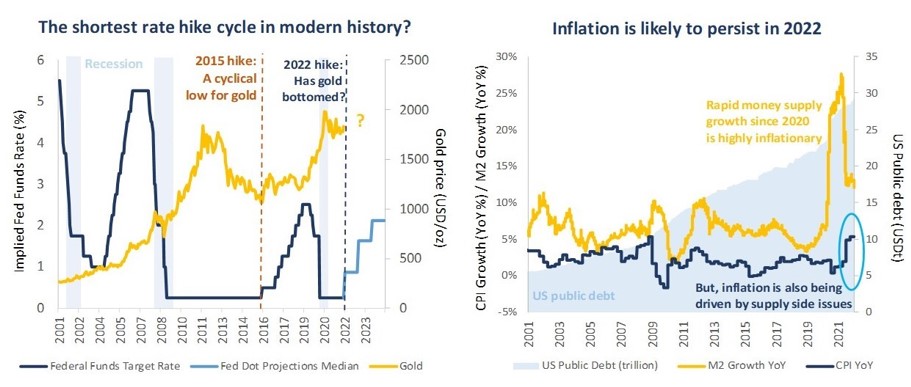

- The prospect of rising nominal US rates has been a key headwind for gold - However, with the US Fed about to begin its rate hike cycle, which will likely be the shortest in modern history, we consider that that the tide will turn for gold during 2022.

- The return of the safe havens - Risks abound, from tense geopolitics and social issues to new COVID-19 variants and challenges of reopening economies. The risk of conflicts involving China and Russia is a growing threat.

The interplay between heightened inflation and rising interest rates is undoubtedly the most influential factor for the near-term direction of the precious metals sector, as well as for broader financial markets at the start of 2022. There is much uncertainty over the ability of policymakers to tame inflation, given the impact on a real economy with high levels of debt, with consumers facing rapidly rising prices. The Federal Reserve got its call on inflation wrong in 2021 and US inflation has subsequently hit a 39-year high. Globally, prices are rising with OECD inflation, which has reached a 25-year high; UK inflation has reached a 30-year high, while the Eurozone faces the highest inflation since the launch of the single currency.

Source: Bloomberg, Baker Steel Capital Managers LLP. Data at 31 December 2021. Note, Fed Dot Plot projection is based on the 15 December 2021 announcement.

The Fed’s challenge is to raise rates just enough to control inflation, without triggering a recession for the US’s indebted economy. Hawkish rhetoric has been employed by Fed officials at the start of 2022, and investors are broadly expecting three to five 0.25% hikes in 2022, but even this would only take the Fed Funds rate to just over 1%, well below pre-COVID levels and far below the forecast inflation rate for the year. We are likely facing the shortest US rate hike cycle in history, as the risks of higher borrowing costs are high for a global economy used to low rates. Monetary expansion will be tapered, however the increase in money supply that has already occurred is vast, with US M2 having ballooned by +12% in 2021 and +25% in 2020. The level of public and private debt in developed markets, after two years of fighting the COVID-19 pandemic and after a decade of accommodative monetary policy before this, makes even a small rise in the cost of borrowing today a dangerous event.

The impact of rising rates is highly significant for commodity markets, particularly precious metals, which tend to have a close negative correlation with real interest rates (rather than nominal rates). Importantly, the start of the last US rate hike cycle in December 2015 marked the bottom of the market for gold, ending the metal’s multi-year bear market. The situation today is different in many ways, yet we believe that the first or second rate rise could once again present a catalyst for gold’s recovery as the limited scope of the cycle becomes clearer. As during the last cycle, hawkish rhetoric has once again been employed by Fed officials in advance of the first hike, to signal their intentions. However, once speculation gives way to reality, a range of scenarios appear positive for gold.

Firstly, under a scenario where the Fed treads carefully and manages to control inflation with a limited set of hikes, the core headwind for gold (the prospect of significantly higher interest rates) will have been removed, allowing for gold price recovery to resume as wealth creation and economic growth continue unimpaired. Under this scenario modest normalisation will have been achieved and the printing presses will be primed once again.

However, the risks of hiking too fast are high and if unsuccessful the US economy faces damaging results, including potentially stagflation, as rising rates weigh on economic growth and business activity, costing jobs and raising unemployment without making a material difference to the inflation rate and the impact of higher prices on consumers. Under this second scenario where the Fed overshoots, raising rates to damaging levels, financial markets face turmoil and the impact on the real economy would be severe. Gold and gold equities might initially be caught up in the rush to cash as equity markets fall, but would likely face rising demand thereafter as both a proven safe haven investment and an effective inflation hedge.

We believe that a third scenario, where the Fed undershoots its projected target is a far more likely outcome. The potentially severely damaging economic impact of higher borrowing costs is a strong deterrent for raising rates quickly, particularly should there be reticence by Jerome Powell to risk the economic recovery around the mid-term elections this year. This outcome would be most supportive of gold, likely setting the stage for the next major bull market phase for the metal and for precious metals miners.

Policymakers have a mixed track record of achieving monetary policy objectives and in this case it seems likely that while a limited interest rate cycle may “tame” inflation somewhat, inflation rates are likely to remain higher than expected for some time. Current inflation is driven by supply side factors as well as demand sided, such as supply chain issues, reshoring and demographic factors, which won’t be solved by higher interest rates. Notably, the cost of working towards net zero, estimated at USD 3-5 trillion a year (or about 3% global GDP) for the next 20 to 30 years, is itself potentially highly inflationary. As a result, it seems highly likely that US real interest rates will remain low, if not negative by historic standards, even as nominal rates rise. As such, we believe that the outlook for precious metals will be strong as the rate hike cycle gets underway.

Alongside the core macroeconomic catalysts for higher gold prices mentioned above, it is also worth considering that gold remains an effective hedge against global events which may negatively impact financial markets. At the start of 2022 the world finds itself in a state of heightened uncertainty and investors face a multitude of risks. The risk of further COVID-19 variants remains a threat to growth and business activity, domestic politics in the US and Europe is fractious and increasingly polarised, while inequality throughout the developed world has continued to increase. Geopolitics, an important factor for gold prices, show no sign of becoming less tense and confrontational, while the threat of conflict looms as Russia and China deliberate over potential military action in Ukraine and Taiwan.

The mining sector offers value, growth and returns

- Mining is one of the few equity sectors offering value – Miners are in strong shape for recovery and a rotation towards value investing could drive a period of “catch up” outperformance.

- A selection of miners offer strong growth prospects – As the cycle turns, sub-sectors of the mining industry offer significant growth potential.

- Active management is key – As in previous cycles, selectivity can significantly enhance potential returns during an up-cycle. A focus on value, margins, dividends and ESG factors is key.

The last commodity supercycle began in the early 2000s, in the aftermath of the Dotcom bubble, driven primarily by the China boom which drove a surge in demand for raw materials lasting over a decade. This cycle ended in 2011 as financial assets began to outperform real assets, driven by the policy response to the Global Financial Crisis. Over the past decade commodities and the mining sector have de-rated relative to broader stock markets, which have enjoyed the longest stretch of gains in history. Yet momentum is building in the resources sector, with strong performance by selected metals in 2020 and 2021. We consider that we are at the start of a new supercycle for commodities, driven by the rapid demand boost from the green revolution, real asset price inflation resulting from the policy response to COVID-19, and the stark monetary imbalances which have grown in recent years.

Furthermore, the case for investors to increase exposure to commodities and miners is growing stronger, as the sector offers diversification, undervaluation and a strong growth outlook. At the time of writing, the benefits of diversification are once again painfully clear, as global equity markets with lofty equity valuations face a sell-off and turbulent outlook, driven by fears over rising nominal rates, rising inflation and geopolitical tension. Gold and gold equities in particular are proven portfolio diversifiers and have retained a low correlation to general stock markets in recent years. Gold’s correlation to equity markets (S&P 500) remains very low, just 0.1 in 2021, lower than bitcoin, real estate and industrial commodities. Furthermore, precious metals demonstrated their safe haven credentials during 2020 as the pandemic raged.

A further bullish market factor for miners is the potential for a rotation back into value by investors, away from the growth theme which has dominated in recent years. The mining sector has reached a point of extreme undervaluation relative to general stock markets. Gold mining equities are the most undervalued subsector, trading on just 9.1x EV/EBITDA, with strong operating margins of 31.1% (XAU Index), compared to the S&P500 Index and NASDAQ trading on 18.5x and 36.5x EV/EBITDA multiples respectively, with operating margins or 12.3% and 9.2%.

Source: Bloomberg, Company Reports, Canaccord Genuity estimates, Baker Steel Capital Managers LLP. Data at 31 December 2021.

Investor sentiment towards miners, particularly gold miners, remains weak, yet the sector is largely in its healthiest shape for many years. With many commodity prices having risen in recent years and with capital discipline continuing to prevail as management teams recall the errors of the last cycle, there are a good selection of high quality companies with robust balance sheets and strong margins. Dividends and buybacks have been rising in recent years among gold producers, a trend which appears set to continue.

2022 offers opportunities and risks for investors in metals and mining

We believe 2022 will see the start of the recovery of the precious metals sector and further momentum for the speciality metals sector, as demand for “future facing” metals continues to rise. We also consider that the significance of commodity markets for investors will grow substantially this year, given the growing appreciation of the central role for critical raw materials as part of the green revolution and for the recovery from the COVID-19 crisis. As the world learns to live with COVID-19 and remains committed to a greener future, demand for metals will continue to grow. Meanwhile the catalysts for change on the macroeconomic and geopolitical fronts support the case for higher commodity prices.

The situation facing the mining sector today highlights some of the key advantages of being an active investment manager in this sector. Stock selection, bottom-up research and a deep knowledge of the sector, coupled with an understanding of the long-term underlying macro trends, are needed to identify those companies best positioned to thrive as commodity prices move higher. With several decades of experience covering multiple cycles, Baker Steel’s team has a unique level of specialist sector knowledge, as well as quantitative tools, most notably GenVal and our other in-house screening tools covering yield, margins, beta and ESG-scoring. Our objective is to deliver superior risk-adjusted returns relative to a passive investment in the sector.