Will Silver Reach $20 in 2020?

THANK YOU FOR POSTING A REVIEW!

Your review was sent successfully and is now waiting for our staff to publish it.

(June 11, 2020 - Taylor Dart)

It’s been a rollercoaster ride to start the month of June for precious metals investors, as silver started off June by vaulting back to its pre-correction levels, only to endure a sharp 7% correction over the following three days. Thus far, the bulls have come in and bought up the dip near $17.00/oz, which suggests that this was likely just a healthy pullback to shake out some weak hands. The other piece of good news is that despite the run-up, we continue to see lukewarm positioning from small speculators, with positioning much lower than the last time we were sitting near $18.00/oz. This divergence between price and positioning suggests that market participants are much less interested in silver than they were at this time last year, and this is occurring right into one of silver’s strongest periods seasonally. While further weakness is possible into the back half of June for silver, the bulls will remain in control as long as they can defend $16.00/oz.

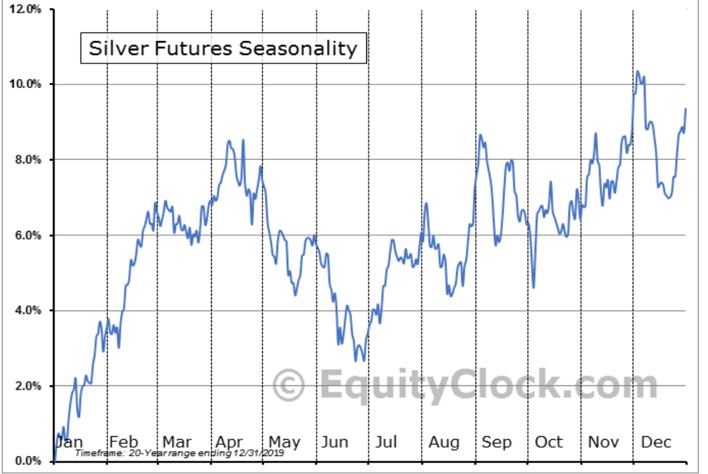

(Source: SeasonalCharts.com, Dimitri Speck)

(Source: SeasonalCharts.com, Dimitri Speck)As we can see in the above chart of seasonality for silver, we’re heading into one of the most attractive times to be buying silver, with the metal typically bottoming in mid-June to early July going back over fifty years. If we look at the above charts, we can see that silver usually gains over 6% between now and the end of Q3, a respectable performance for just over a 3-month hold period. Despite this attractive timing window to be buying pullbacks in silver, we didn’t see any sign of this last week from small speculators, with bullish positioning remaining at relatively subdued levels. Let’s take a closer look below:

The above chart measures the silver price (white line), with the 1-month moving average of positioning among small speculators (blue line) to assess the relationship between the two. As the above chart shows, the last two times we were hovering near $18.00/oz on silver, we had small speculators sitting on over 50,000 contracts of the metal. This suggested that the trade was quite crowded, and that became a headwind as many traders were already bullish. Currently, however, we’ve got only 30,800 long contracts on the 1-month moving average as of last Friday, which suggests that there’s zero exuberance to be found in this trade. Therefore, while positioning was previously a headwind in August of last year and January of this year, it is no longer a headwind. Based on this, it’s possible that silver could make another run at $20.00/oz this year.

So, what’s the best course of action here?

We currently have strong resistance silver at $18.95/oz, with strong support for the metal at $16.00/oz near the rising 50-day moving average. While I wouldn’t be chasing silver above $18.25 with this resistance level looming overhead, I believe that any drops below $16.95/oz will present buying opportunities. The key, however, is that the bulls defend the $16.00/oz level at all costs, keeping the metal above its key monthly moving averages. Given that we have small speculators completely uninterested in silver despite the metal being up 40% off of its lows, I continue to believe that a move up to $20.00/oz is a possibility before year-end. Having said that, a few weeks of consolidation or a further pullback would be healthy to reset the high sentiment readings we got in early June.

-

Goldman Sachs Says Gold’s Bullish Momentum Remains Even If The Fed Maintains Restrictive Rates By

Mint State Gold

May 1 2024