Don’t Stop Me Now: Central Bank Demand In August

THANK YOU FOR POSTING A REVIEW!

Your review was sent successfully and is now waiting for our staff to publish it.

(October 7, 2019 - Krishan Gopaul of Market Intelligence Group | World Gold Council)

Today we have published our latest central bank data for August. As usual, I’ll be summarising the key highlights. But if you want to dig a little deeper, you can find out central bank data set here.

Gross purchases (of a ton or greater) amounted to 62.1t in August, while gross sales were 4.8t by comparison. As a result, net purchases came to 57.3t. This is significantly higher than the modest demand of 12.8t in July. As we’ve spoken about previously, global uncertainty remains elevated with little indication that it will fall anytime soon. Against this backdrop, central banks continue to see a role for greater levels of gold in their reserve portfolios.

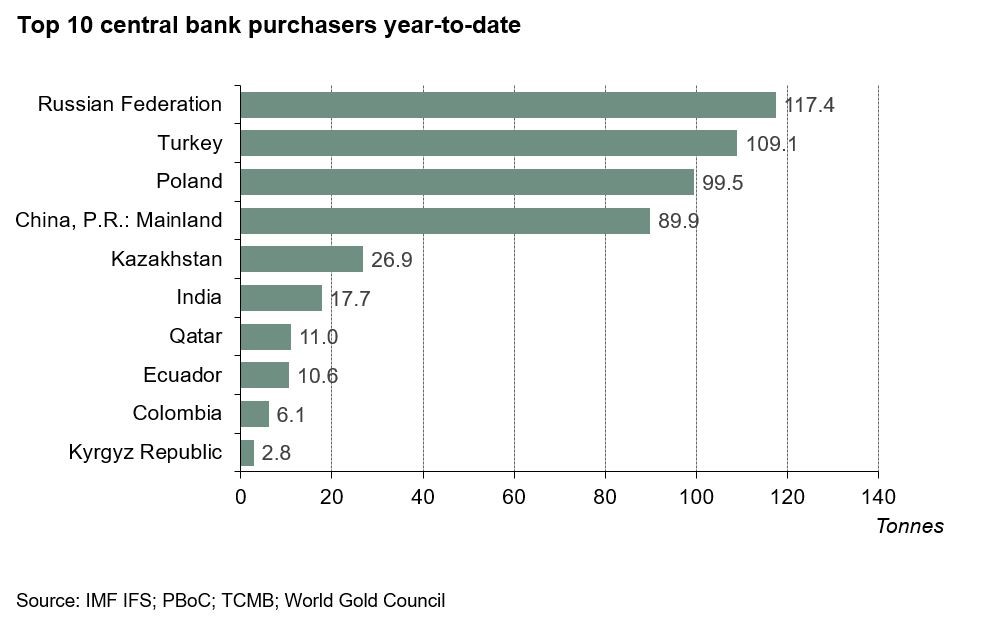

Same same, but different. Unlike previous months however, where we’ve seen several active purchasers, gross purchases in August were concentrated amongst four central banks. Of the total gross purchases, Turkey’s sizeable addition (+41.8t) to its gold reserves account for around two-thirds. Russia (11.3t), China (5.9t) and Qatar (3.1t) were the others that grew gold reserves by a tonne or more. Gross sales – again, totalling a tonne or more – were limited to two central banks: Kazakhstan (2.6t) and Uzbekistan (2.2t).

On a net basis, reported year-to-date purchases – of a tonne or more – now total over 450t. Of this, a total of 14 central banks have increased their gold reserves to far in 2019, compared to only two than have decreased their gold reserves. Should central banks remain net purchasers this year – which is looking like a racing certainty – it’ll also mark a decade since they switched from being net sellers.

-

Goldman Sachs Says Gold’s Bullish Momentum Remains Even If The Fed Maintains Restrictive Rates By

Mint State Gold

May 1 2024