How Gold Prices May Hit $1,700 In Just 6 Months

THANK YOU FOR POSTING A REVIEW!

Your review was sent successfully and is now waiting for our staff to publish it.

(October 24, 2019- Damian Wood)

- According to Australia and New Zealand Banking Group (ANZ), the price of gold is set to hit $1,700 an ounce in the next 6 months

- The multinational bank predicted the precious metal's price after taking into account gold's three main drivers in a zero-coupon inflation-adjusted U.S. Treasury bond.

- President and global strategist at Independent Strategy, David Roche, also believes that the gold price will go beyond the $1,700-mark next year.

In its latest reports, Australia and New Zealand Banking Group (ANZ) has decided to take on the challenge of determining the “unpredictable” gold prices.

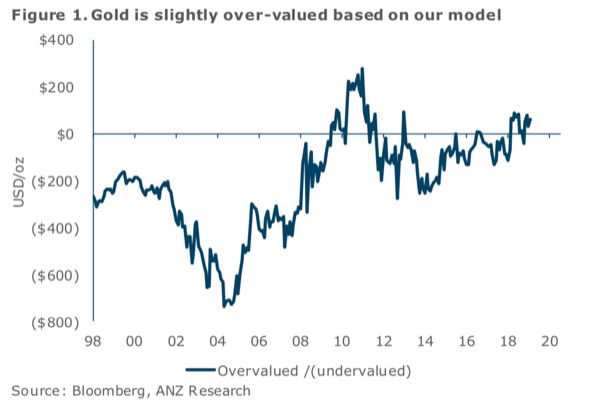

Interest rates, inflation, and the USD being key gold price drivers, the Australian multinational bank discovered that the fair price of an ounce of gold averaged at $1,400, a figure that is close to $100 below the current market rate.

“We looked at all the traditional factors and compared their relative valuation against gold to determine whether it is over- or under-valued. We found that gold is primarily driven by interest rates, inflation expectations, and the USD,” wrote ANZ senior commodity strategist Daniel Hynes and commodity strategist Soni Kumari. “Based on current prices, our model shows gold’s current fair value is around USD1,400/oz.”

But ANZ concluded by saying gold bugs shouldn’t worry too much as the gold price could surpass USD1,700/oz over the next six months.

“Our model also suggests prices could breach USD1,700/oz over the next six months. This offers opportunities for consumers, producers, and investors. A pullback to fair value, in the short term, could present an opportunity for increased exposure to the metal,” Hynes and Kumari said. “With solid fundamentals, gold remains a good prospect for portfolio diversification.”

But the president and global strategist at Independent Strategy, David Roche, believes the gold price will go beyond the $1,700-mark next year. With an ounce going for $1,493 today, David’s 30% surge prediction by next year could easily see gold hit $2,000 an ounce.

“What my gut says is that cause of the vilification of fiat currencies by central bankers, which is set to get worse — not better, people will look for an alternative currency,” Roche told CNBC’s “Squawk Box” on Thursday.

“Gold is a good alternative currency because it’s safe, and because it costs nothing to own it compared to paying negative rates on deposits,” Roche said

Gold prices will likely touch $1,600 before the end of this year, before moving higher to $2,000 next year, he added.

While David Roche’s and ANZ’s price predictions slightly differ, they both agree that the price of gold is set to surge in the next couple of months.

The model used by ANZ took into account gold’s three main drivers in a zero-coupon inflation-adjusted U.S. Treasury bond.

“We used the yield of a 30-year bond in our calculations. To help mirror the impact of the USD, we included a USD factor using a regression model in our algorithm,” the strategists said. “According to our model, our valuation for gold is USD1,410/oz, based on spot prices as of 18 October. In September 2019, on average gold traded at a premium of USD90/oz to our model valuation. This premium has been in place since October 2018, when gold prices were trading around USD1,200/oz before the currently rallying to over USD1,500/oz.”

Gold was mostly undervalued until the financial crisis of 2008 when its price began to strengthen.

-

Goldman Sachs Says Gold’s Bullish Momentum Remains Even If The Fed Maintains Restrictive Rates By

Mint State Gold

May 1 2024