How To Get Started With Gold-Coin Investing

(June 25, 2019 -Philip van Doorn, Investing columnist with MarketWatch)

Gold is a hedge against financial risk, and coins offer convenience

A one-ounce 22-carat American Eagle gold coin.

A one-ounce 22-carat American Eagle gold coin.

You might think those annoying TV ads for gold and silver coins give coin collecting a bad name.

It turns out, however, that gold and other precious coins are the easiest collectible item to trade, whether you are investing in bullion coins as a hedge against inflated stock and bond prices or if you’re interested in building a special collection of rarities.

Barry Stuppler, a coin dealer in Los Angeles who is the president of the Professional Numismatists Guild (PNG), discussed how investors can get started with something they may never have considered before, or maybe thought would be impractical. The PNG is a group of about 300 of the largest U.S. coin dealers. There are high barriers to joining the guild, and these dealers provide liquidity to smaller dealers across the country. (Numismatics is the study of coins and metals.)

Stuppler is a former president of the American Numismatic Association (ANA), which has membership open to the public and provides support and educational services to collectors at all levels.

‘Rare coins have the best liquidity of any collectible out there.’ Barry Stuppler, president of the Professional Numismatists Guild

Bullion coins

It is understandable for investors used to the instant liquidity of the stock market to shy away from investing in collectible items, but Stuppler said during an interview that “rare coins have the best liquidity of any collectible out there.”

For investors, the revolution started by Charles Schwab in the 1970s has led to very low commissions for stocks and bonds. But for many other things, commissions can be quite high. Even for an ordinary item, such as a house, you will typically pay a 6% commission to sell through a real-estate agent who uses multiple listings.

Investors looking to “play” the price of gold can simply buy shares of the SPDR Gold Shares ETF or various other ETFs and mutual funds that hold gold bullion or invest in shares of gold-mining companies.

But you can also invest in bullion coins, such as American Eagle one-ounce gold coins that are produced by the U.S. mint, which trade at low premiums to the spot price of gold. (The U.S. mint charges a 3% premium for new coins.) Their small size makes them convenient for delivery and storage. And the commissions for bullion coins typically range between 1.5% and 2%, according to Stuppler.

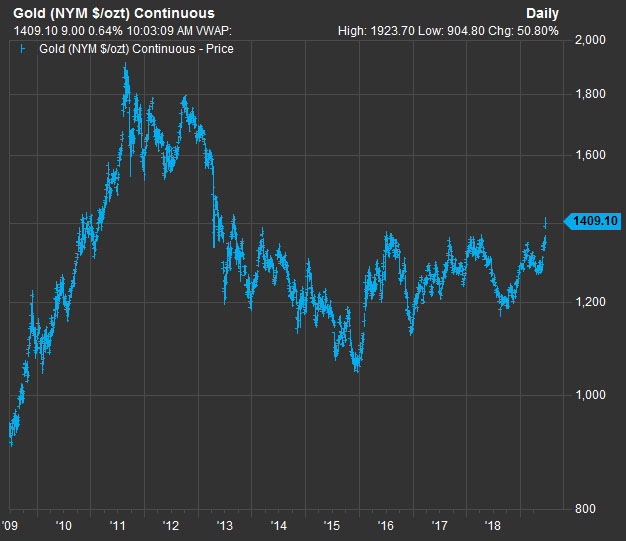

Here’s a chart showing the price of gold in U.S. dollars, over the past 10 years:

FactSet

FactSet

The spot price of gold on the New York Mercantile Exchanged peaked at $1,923.70 on Sept. 6, 2011, according to continuous contract quotes provided by FactSet.

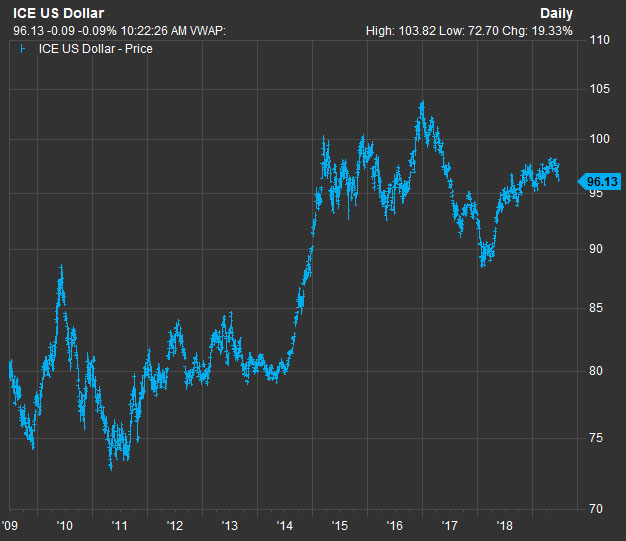

You can see that the price of gold in U.S. dollars peaked in 2011. But this is very much a function of the rise in the value of the dollar. The U.S. Dollar Index shows the value of the dollar against a basket of other currencies. Here’s how it has performed over the past 10 years:

FactSet

FactSet

So when people say gold has been a bad investment in recent years, they may only be thinking about the metal’s relationship to the dollar. “In India, for example, it is at an all-time high,” Stuppler said.

Of course we cannot know how long U.S. interest rates will remain much higher than those in other developed countries — a major reason for the dollar’s strength. But it is conceivable that there will be a far different monetary environment at some point, which will bode well for the price of gold (in dollars) and lead to rare gold coins trading at higher premiums over the spot price for gold (see below).

Rare coins

This is where emotions come into play. You might find coins of all types fascinating. You might combine this interest with a portion of your investment portfolio.

A lot of people have a small collection of coins they have found to be interesting, quite possibly sitting in the top drawer of a dresser. Then one might be curious about rare coin listings on eBay the aforementioned TV ads or even a telemarketer’s pitch.

Stuppler advises anyone who finds coins offered through these channels to be of interest to “call a professional numismatist and you will probably find they charge significantly less” than the TV advertisers and telemarketers, because of those businesses’ additional marketing expenses.

Barry Stuppler, president of the Professional Numismatists Guild.

In addition to the PNG and the ANA, there are state organizations that list accredited coin dealers.

If you are looking to invest in a rare coin, commissions can be higher than they are for bullion coins, but the U.S. market is still highly liquid. You can typically make a sale and get paid within 48 hours. Here’s an example of a rare coin that is easily traded: St. Gaudens $20 gold coins were minted between 1907 and 1932.

A 1908 St. Gaudens $20 gold coin.

A 1908 St. Gaudens $20 gold coin.

Uncirculated St. Gaudens coins are trading these days at premiums ranging between 8% to 10% of the spot price for gold bullion which Stuppler said was unusually low, reflecting the strength of the U.S. dollar. Stuppler said these coins typically trade at premiums of 30% to 40% over the spot price.

The Collectors Corner website can give you an indication of the scale and the liquidity of the U.S. market for coins. If you click on “coins” at the top left of the site, you can see the categories of rare coins that are available, and then click those categories to see the actual listings from collectors and dealers.

Commissions for rare coins are higher than those for bullion coins. They typically range from 5% to 10%, Stuppler said. But “if you compare that to any other legitimate collectible, the fee that auction houses charge can be 20% or more,” he said, adding that the auction process, including escrow, can mean a wait of many months before the seller gets paid.

Coin collectors can register collections that they want others to know about. For example, PCGS has over 100,000 registered coin collections across the valuation spectrum.

Collectible coins can be very expensive, and there are very serious collectors who spend many years — and many millions — putting together special collections. However, there are also collections that have been created for relatively low cost. Within PCGS’s U.S. coins category, there is a section for dollar coins, which includes 2,430 registered sets of Eisenhower dollars, which were minted between 1971 and 1978, for example.

Once collectors move beyond being hobbyists, they can be quite serious and build fascinating collections. “It does not have to be a lot of money. It can be anywhere from $5,000 to $5 million. They are typically long-term oriented,” Stuppler said.

(June 25, 2019 -Philip van Doorn, Investing columnist with MarketWatch)

(June 25, 2019 -Philip van Doorn, Investing columnist with MarketWatch)