Australians Snap Up Gold As Market Uncertainty Rises

(June 10th, 2022-Jaspar Crawley)

Australian gold production dates back over 170 years. As the third largest producer of gold in the world, Australia registered nearly $18b USD worth of gold exports in 2021[1], making gold Australia’s fourth largest export by value, behind iron ore and energy.

Geopolitical uncertainty, inflationary concerns and rising interest rates have impacted global financial markets so far this year. Australia’s Consumer Price Index (CPI) rose to 5.1% in Q1, the highest since Q2 2001.

Against this backdrop, gold shone in Q1, registering a 4% gain in Australian dollars versus losses of 0.1% for Australian equities and -6% for Australian bonds [2]. And the near future may bring additional challenges for Australian investors such as heightened equity market volatility and a questioning of whether bonds can perform a defensive role in a portfolio.

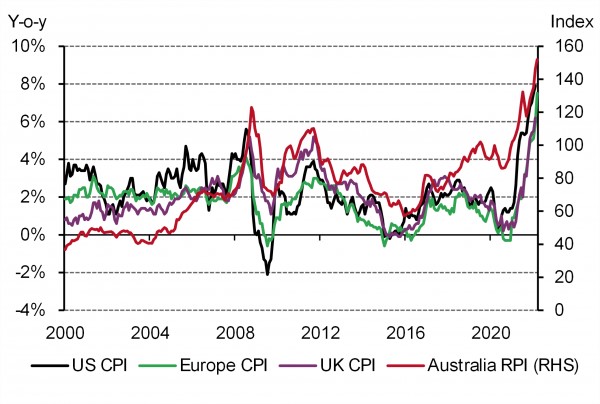

Inflation remains elevated in many countries (Chart 1). Global money supply has climbed at an unprecedented rate since the outbreak of the pandemic, seeding higher inflationary pressure, and surging commodity prices have poured oil on the flame. For instance, in the US, y-o-y growth in the Consumer Price Index (CPI) reached 8.3% in April, the highest in decades.

Chart 1: Inflation rates are soaring across the globe*

*As of April 2022. We use the Australian Retail Price Index, which updates monthly to replace the nation’s Consumer Price Index, which is published on a quarterly basis.

Source: Bloomberg, World Gold Council

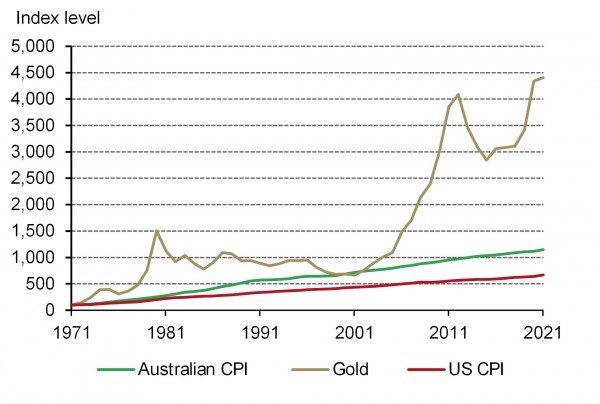

Gold can help portfolios outrun inflation. Its effectiveness as an inflation hedge is partially underpinned by its stable and relatively limited supply, as well as by the fact that real interest rates, often viewed as the opportunity cost of holding gold as investors forfeit returns on bonds, are generally low when inflation is high[3].

Chart 2: Gold has outrun consumer price indices

Gold, US CPI and Australian CPI indexed, 1971=100*

*Based on annual data of the Australian consumer price index, gold price in USD and US consumer price index between 1971 and 2021.

Source: Bloomberg, ICE Benchmark Administration, World Gold Council

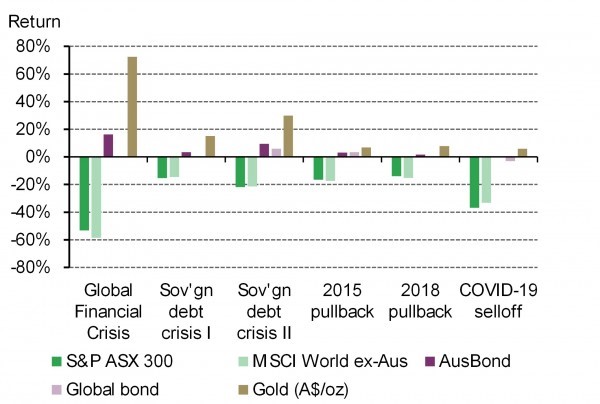

Furthermore, investors often rush to gold during times of crisis, exactly as we saw in response to the Russia-Ukraine crisis. Historical data shows gold has a proven record of being an effective tail risk hedge (Chart 3).

Chart 3: Gold offers protection in tail risk events*

* Based on S&P ASX 300 Stock Index, MSCI World Ex-Australia Index, Bloomberg AusBond 0 yr+ Index, Bloomberg Barclay Global Agg Index and LBMA Gold Price AM. All calculations are in AUD.

Dates used are: Global financial crisis: 11/2007-3/2009; Sovereign debt crisis I: 4/2010-7/2010; Sovereign debt crisis II: 2/2001-10/2011; 2015 pullback: 6/2015-2/2016; 2018 pullback: 8/2018-12/2018; COVID-19 selloff: 2/2020-3/2020.

Source: Bloomberg, ICE Benchmark Administration, World Gold Council

It seems these positive attributes have been spotted by Australian investors. In the first quarter of 2022, Australian investors snapped up over 6 tonnes gold bars and coins, amounting to a +19% increase in demand versus the same period in 2021. Superannuation funds have also started to look more closely at gold. Why?

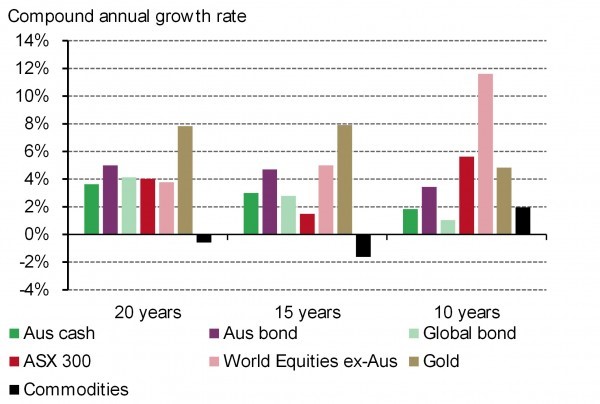

Firstly, gold’s returns are competitive. Since 1971, gold has compounded returns of 8.9% in Australian Dollars. Gold’s returns on a shorter time frame, say the last 20, 10 and 5 years, have been solid and challenge other assets that Australian investors hold.

Chart 4: Gold has provided superior returns over the past 20, 15 and 10 years

Major assets' compound annual growth rate*

*Based on Bloomberg AusBond Bank Bill Index, Bloomberg AusBond 0+yr Index, Bloomberg Global Agg Bond Index, S&P ASX300 Index, MSCI World Ex-Australia Index, Bloomberg Commodity Index, LBMA Gold Price AM between March 2002 and March 2022 due to data limitation. All calculations are in AUD.

Source: Bloomberg, ICE Benchmark Administration, World Gold Council

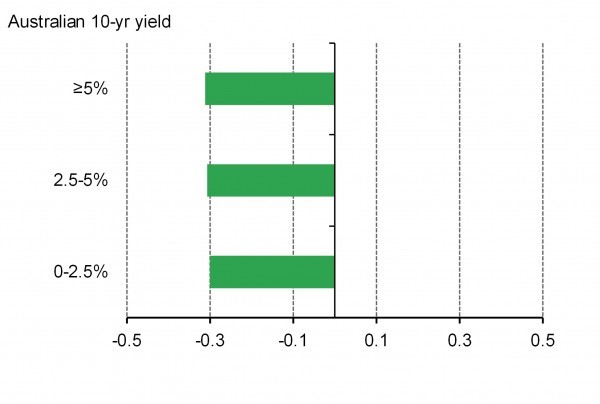

Secondly, gold’s ability to improve a portfolio’s performance works through diversification. We’ve already mentioned event risk, and a further way to look at gold is through its relationship with other portfolio assets. For instance, gold in Australian dollars has exhibited a persistent negative relationship with the local equity market since 2000 (Chart 5) across various rate levels. This means you have an asset that gives your portfolio returns but behaves differently to the other assets you own – very useful when those other assets fall in value.

Chart 5: Gold’s role as an equity market hedge remains consistent despite rate levels

Correlation between gold and S&P ASX300 stock index across various rate levels*

*Based on monthly data of the S&P ASX 300 Stock Index and LBMA Gold Price AM in AUD, between January 2000 and February 2022.

Source: Bloomberg, ICE Benchmark Administration, World Gold Council

What about cryptocurrencies? Since 2018 we have argued that diversification is a key differentiator between gold and cryptocurrencies such as bitcoin. This year has seen this argument play out: equities, in particular tech stocks represented by the NASDAQ, fell -21% this year in USD terms, and bitcoin fell -17% to end-April. Gold rallied +3.7% in USD during the same period, retaining that negative correlation with a sharply dropping equity market. Whilst the longer-term performance of cryptocurrencies has been noteworthy, their purpose as an investment seems quite different from gold.

Another appeal of gold is its deep and liquid market that trades around $190bn Australian Dollars per day. In stark contrast to many financial markets, gold’s liquidity does not dry up, even at times of financial stress – meaning you can convert gold to Australian Dollars quickly and easily when you need to.

Long-term returns, liquidity and effective diversification all benefit overall portfolio performance. In combination, they suggest that the addition of gold can materially enhance a portfolio’s risk-adjusted returns: this means improving the amount of return you receive for the volatility your asset values suffer. Our analysis of investment performance over the past two, five, 10 and 20 years underlines gold’s positive impact on an Australian superannuation portfolio. It shows that the average super portfolio would have achieved higher risk-adjusted returns and lower drawdowns if 2.5%, 5% or 10% were allocated to gold (Table 1). This positive impact has been particularly marked since the 2007-8 Great Financial Crisis.

* Based on performance between 31 December 2001 and 31 December 2021. The hypothetical average Australian superannuation fund portfolio is based on the Australian Prudential Regulation Authority’s superannuation asset allocation update in 2021

Source: Bloomberg, ICE Benchmark Administration, Australian Prudential Regulation Authority, World Gold Council

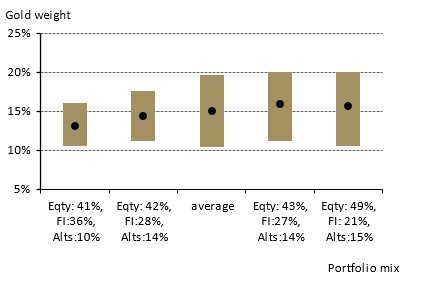

How much gold should you own? The ‘optimal’ amount of gold varies according to individual asset allocation decisions. Broadly speaking, our analysis suggests that the higher the risk in the portfolio – whether in terms of volatility, illiquidity or concentration of assets – the larger the required allocation to gold, within the range in consideration, to offset that risk (chart below).