"Physical Demand Will Completely Overwhelm Supply" And How Silver Could Wind Up Over $270

(September 11th, 2021 - Tyler Durden)

This is Part 1 of a two-part interview with Andy Schectman, President & Owner of Miles Franklin Precious Metals, a company that has done more than $5 billion in sales. Andy is a world-renowned expert in the field of precious metals and took the time to answer some pressing questions I had about the possibility of a real silver squeeze, the precious metals market, the Fed, and the future of money worldwide. He has been a frequent guest on my podcast, as well.

Q: Hi Andy, thanks for joining me. Is a silver squeeze really even possible given the massive size of the silver market? In layman's terms, how could it happen?

A: More silver is being consumed than is being mined each year. Last year, approximately 850 million ounces were mined globally, with a demand of over one billion ounces. The industrial demand for silver is surging in an increasingly digital world, with new applications every day in green energy and battery powered vehicles.

At the same time annual global mine supply is declining and industrial demand is increasing, a global renaissance in monetary demand is upon us. This is happening while a handful of large Wall Street bullion banks have manipulated the price of monetary metals for decades, allowing some of the biggest money in the world to accumulate massive amounts of physical gold and silver at subsidized prices.

The physical demand filters down from the top. Over 300 million ounces of silver were removed from the Comex market in 2020 by some of the most sophisticated and well healed investors in the world. Settlements on the Comex are usually mostly in dollars. The Comex was not set up to be a source of physical delivery. This is no small development. In years past, this amount would represent roughly a decade’s worth of silver deliveries. In addition, Comex deliveries in 2021 are now on pace to better the 2020’s delivery numbers. When all of this is added to record global retail physical demand in coins and bars - physical demand at some point and probably sooner rather than later, will completely overwhelm supply.

In geological terms, silver is found in a form called epithermal, meaning it is found very near the surface. This means that most of the big deposits were found years ago, even before the advent of enhanced imagery. In fact, only 30% of global mine supply comes from primary silver miners, while 70% comes as a byproduct of mining other metals such as copper and zinc.

In summary, the demand for physical silver is greater than the supply - the amount being mined each year. And it’s expanding. At the same time, silver is in the cross hairs of a new class of “deep pocket” investors, from hedge funds to home offices. And the “retail” demand is on the rise as well. As an example, our business at Miles Franklin is up between 300% - 400% and it is 95% silver. This new, large demand is, in part, being funded by savvy investors taking profits on stocks and Bitcoin.

Most commodities have one primary source of demand, like copper – which is solely and industrial metal, and gold, which is mostly a monetary metal. Silver is in demand by both industry and investors. At some point they will be in competition with each other. That point is not far off. So yes, I think a squeeze is not only possible but actually highly probable.

Q: Andy, you've been in the precious metals business for decades. Where would you pin the true price of silver and gold right now?

A: Much higher! Due to the relentless market manipulation, there is no accurate way to find honest price discovery. So far, supply and demand of physical silver has had little effect on the paper prices set on the Comes. It is impossible to determine the true, unmanipulated price.

When you factor in money creation and inflation, plus the rise in all commodities, gold at $3,000 seems on the low side to me. Of course, this is just a subjective guess.

Silver is perhaps the most undervalued asset on the planet and in my opinion, it presents the buying opportunity of a generation. The silver to gold ratio is currently 75 to 1. It takes 75 ounces of silver to “buy” one ounce of silver. Yet only seven ounces of silver are coming out of the ground for every one ounce of gold. In other words, at a 7 to 1 ratio, silver is nearly 11 times undervalued in its relation to gold. Further if you divide the current price of gold ($1,800) by 7, the current global mining ratio, you get a silver price of $270. With $3,000 gold, a minimum number I expect to see sooner than later, you get $428 an ounce.

Q: One of the things I just wrote about was China potentially backing its new digital currency with gold. Do you think China would consider backing the digital Yuan with gold? What would the ramifications be for the price of metals and the FX markets?

A: Yes, I think that is their plan. I think they will back the new digital Yuan in a nonconvertible fashion. I don’t think you will be able to trade in a digital yuan for a piece of gold, but I do believe gold backing is ultimately highly probable. The Chinese do sell gold-backed yuan bonds that can be converted into physical gold on the Shanghai Gold Exchange.

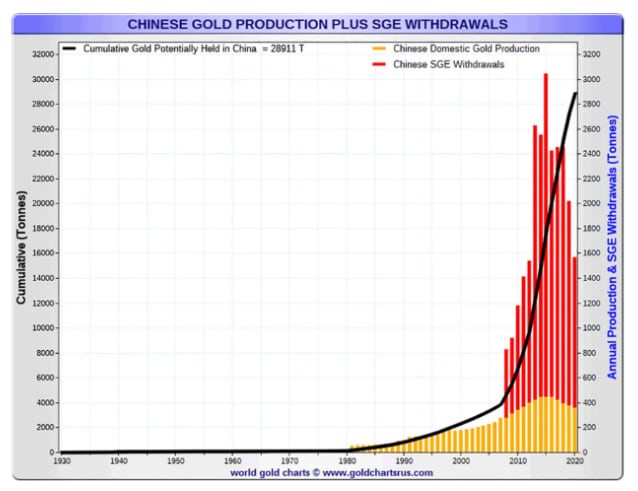

(MoneyWeek’s estimate of Cumulative gold potentially held in China is the black line)

According to the most recent estimates, the Chinese have 38,000 tons of gold. Broken down, 20,000 tons are owned by the state and 18,000 tons are owned by the people. That is almost 5 times as much as the 8133 tons the United States supposedly owns. Further, the new Chinese Belt, Road and Rail Initiative, connecting Asia and Africa and 70% of human population, is the most ambitious infrastructure project in human history and the new Digital Yuan will be the currency of choice for this project. This in effect introduces a new settlement currency to 7 out of 10 people in the world. Gold backing of their new digital Yuan with validation of the holdings on a distributed ledger would immediately create demand and credibility for the Digital Yuan. In one form or another, I believe that is exactly what will happen. You don’t want to own dollar denominated assets when that happens.