China's Renminbi Will Rival the Dollar As Global Reserve Currency

(January 9, 2019 - Tyler Durden)

The past year was full of events that inevitably split the global geopolitical space into two camps: those who still support using US currency as a universal financial tool, and those who are turning their back on the greenback.

Global tensions caused by economic sanctions and trade conflicts triggered by Washington have forced targeted countries to take a fresh look at alternative payment systems currently dominated by the US dollar.

So far, China, India, Turkey, Iran, and Russia have all taken steps towards eliminating their reliance on the greenback, and the reasons behind their decision.

But while those nations could be conceived by many as "enemies" that could be forgiven for daring to question the hegemon, we must admit we were a little surprised at just how frank Bank of England Governor Mark Carney was during a lengthy Q&A this morning...

Jason Bond was a broke schoolteacher deep in debt with no hope… Until he discovered THREE simple patterns that would forever change his life. Now he shows others how they can do it. You owe it to yourself to watch exactly how Jason did it right here.

One of the first questions asked was:

"Does he envisage one of the types of IMF SDRs to become a global currency in his lifetime? If so, will it be crypto/blockchain/gold 'backed'?"

Carney's response was oddly honest and open...

"The IMF’s SDRs are designed for a specific purpose – to supplement IMF member countries’ official reserves and so help them to address balance of payments problems. So they are not intended to become a widely accepted means of exchange – what most people understand ‘currency’ to mean.

OK, so definitely got the message - Don't look over here at the SDRs...

Trending Articles

China's Uber Wealthy Are Preparing For $24 Trillion Tax…

People like to complain that China has abandoned its Communist values in favor of state-directed capitalism. But in at…

What about other currencies?

"That said, I think it is likely that we will ultimately have reserve currencies other than the USD. The evolution of the global financial system is currently lagging behind that of the global economy, and there are asymmetric concentrations of financial assets in advanced economies relative to economic activity.

For example, EMEs’ share of global activity is now 60%, but their share of global financial assets lags behind at around one-third. And half of international trade is currently invoiced in US dollars, even though the US has a much lower 10% share of international trade. As the world re-orders, this disconnect between the real and financial is likely to reduce, and in the process other reserve currencies may emerge. In the first instance, I would expect these will be existing national currencies, such as the RMB.

However, history suggests these transitions will not happen overnight. The US economy overtook Britain’s in the second half of the 19th century, but it took until the 1920s before it became a dominant currency in international trade. "

"Nothing lasts forever"

Carney was skeptical about the possibility of cryptocurrencies such as bitcoin rivalling national currencies as a reserve instrument.

"It is early days for cryptoassets, but in their current form they are not promising as a form of money let alone as a global currency. They are poor stores of value – for example there is extreme daily variation in their value. Cryptoassets are not accepted on the high streets or at online retailers as a form of payment in the UK. And they currently raise a host of issues around consumer and investor protection, market integrity, money laundering, terrorism financing, tax evasion, and the circumvention of sanctions which authorities here and overseas are working to address."

And as a follow-up, one person asked:

"Do you think trade wars and sanctions policies against Iran by the Trump administration are accelerating the decline of the USD as reserve currency as China offers RMB-denominated options for bypassing traditionally USD events (ie Shanghai oil futures market)."

But by then Carney had had enough and concluded his Q&A.

However, while Carney was comfortable claiming that the USD could lose its reserve status, he was notably opposed to a return to a gold standard:

"It would be undesirable to base the value of a global currency on gold. Under the Bretton Woods system – the international system of linking exchange rates to the US dollar which was pegged to gold existing from 1944 to 1971 – there was a fundamental tension in that the global supply of gold did not grow in line with the global demand for money. This tension peaked in the early 1970s and the system collapsed. Since then, major economies have moved towards a system of floating exchange rates, and the basis for the SDR's valuation has also been switched from gold to the more stable arrangement of valuation based on a basket of currencies. "

We have a simple response to Mr.Carney - that's the point of it - a feature not a bug!

However, as Alasdair Macleod recently detailed, if the yuan is to replace the dollar for China’s trade, a policy that leads to the mass accumulation of dollars has to be terminated at some point.

The answer is to back the yuan with gold

Major-General Qiao made it clear to the CCPCC that the dollar achieved global domination only after August 1971, when the link with gold was abandoned and replaced with oil. The link with oil was not through exchange values, as had been the case with gold, but through a payment monopoly. In Qiao’s words, “The most important thing in the 20th century was not World War 1, World War 2, or the disintegration of the USSR, but rather the August 15, 1971 disconnection between the US dollar and gold.”

Strong words, indeed. But if that’s the case, the Chinese will know that the most important event of this new century will be the destruction of the dollar’s hegemonic status. It requires careful consideration, and many unforeseen consequences may arise. The Chinese know they must not be blamed for the dollar’s demise.

So long as the world economy continues to grow without periodic credit dislocations, then China needs only to react to events, doing nothing overtly to undermine the dollar. She need never seek reserve currency status. No one can complain about that. But while central bankers may presume that they have banished credit crises, the reality is different. An independent, market-based view of the current credit cycle is that the onset of another credit crisis is becoming more likely by the day. That being the case, on current monetary policies China’s economy can be expected to crash, along with those of the West’s welfare states.

China’s manufacturing economy will be particularly hard hit by the rise in interest rates that normally triggers a credit crisis. Higher interest rates turn previous capital investments in the production of goods into malinvestments, because the profit calculations based on lower interest rates and lower input prices become invalid. This is a greater problem for China than for many other economies, because of her emphasis on the production of goods. In short, unless China finds a solution to the next credit crisis before it hits, she could find herself in greater difficulties than states where the production of goods is a minority occupation, purely from a production point of view.

From what we know of their strategic analysis of money and credit, the Chinese should be aware of the cyclical risk to production. If the yuan and the dollar go head-to-head as purely fiat currencies, the yuan will be the loser every time. It would mean the yuan would inevitably sink faster than the dollar in the run-up to the credit crisis, which appears to be happening now. As Qiao puts it, China is already being harvested by America. At some stage, China must act to protect herself from this harvesting. And that’s where her gold comes into play.

Stabilizing the currency and the economy with gold

China originally accumulated undeclared reserves of gold as a prudent diversification from holding nothing but other governments’ liabilities. This then turned into a quasi-strategic policy, through encouraging her citizens to accumulate gold as well, while continuing to ban them from owning foreign currencies. We know roughly how much gold her own citizens have, but we can only guess at the state’s holding. It will soon be time for China to declare it.The reasoning is straightforward. At this late stage in the global credit cycle, and so long as the yuan is unbacked, yuan interest rates will rise to the point where Chinese business models will be destroyed. The only way that can be stopped is to link the yuan to gold, so that interest rates align with that of gold, not the rising rates of an unbacked yuan weakening against the dollar whose interest rates are rising as well.

China will be taking a major step by putting an end to the dollar era that has existed since August 1971, when gold as the ultimate money was driven out of the monetary system. She must be ready to do this urgently, despite the opinions of Western-educated economists within her own administration. Some Western central banks may face acute embarrassment, having sold and leased their gold reserves, so that they are no longer in possession. China must move soon to avoid further rises in dollar interest rates undermining the yuan even more.

That time must be approaching. China must resist the temptation to defer such an important decision, allowing the yuan to fall much further. The neo-Keynesians in Beijing will argue that a lower yuan will compensate exporters facing American tariffs. But all that does is drive up domestic prices, and increase the cost of commodities required for China’s infrastructure plans. No, the decision to move must be sooner rather than later.

Assuming China has significant undeclared gold reserves, this could be done very simply through the issuance of a perpetual jumbo bond, paying coupons in gold or yuan at the holder’s option. This financial model, without the gold convertibility feature, is based on Britain’s Consolidated Loan Stock, first issued in 1751 and finally redeemed in 2015. Being undated, there was no capital drain on the exchequer, except at the exchequer’s option.

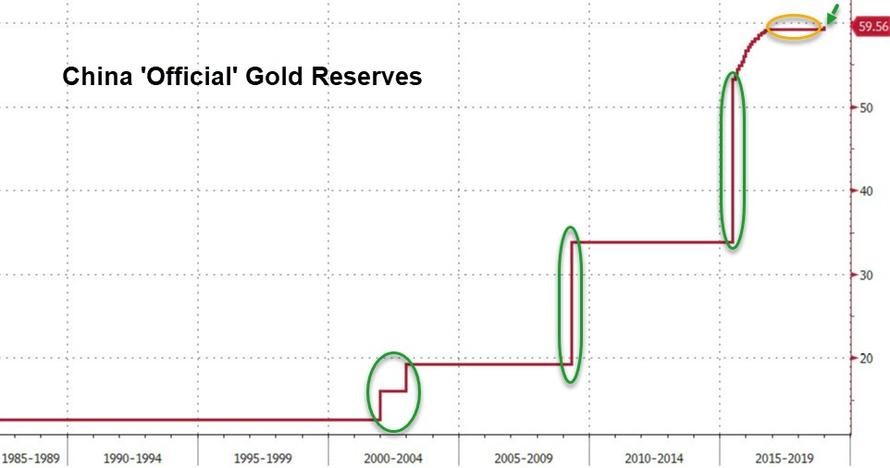

China's official gold reserves rose for the first time in around two years (since Oct 2016)...

China's gold reserves had been steady at 59.240 million fine troy ounces from October 2016 to November 2018, according to data from the People’s Bank of China, and suddenly jumped to 59.560 million fine troy ounces at end-December.

...

Ultimately, a return to sound money is a solution that will do less damage than fiat currencies losing their purchasing power at an accelerating pace. Think Venezuela, and how sound money would solve her problems. But that path is blocked by a sink-hole that threatens to swallow up whole governments. Trying to buy time by throwing yet more money at an economy suffering a credit crisis will only destroy the currency. The tactic worked during the Lehman crisis, but it was a close-run thing. It is unlikely to work again.

Because China’s economy has had its debt expansion of the last ten years mostly aimed at production, if she fails to act soon she faces an old-fashioned slump with industries going bust and unemployment rocketing. China offers very limited welfare, and without Maoist-style suppression, faces the prospect of not only the state’s plans going awry, but discontent and rebellion developing among the masses.

For China, a gold-exchange yuan standard is now the only way out. She will also need to firmly deny what Western universities have been teaching her brightest students. But if she acts early and decisively, China will be the one left standing when the dust settles, and the rest of us in our fiat-financed welfare states will left chewing the dirt of our unsound currencies.