Ditch the Dollar, Buy Gold and Other Currencies Says JP Morgan

THANK YOU FOR POSTING A REVIEW!

Your review was sent successfully and is now waiting for our staff to publish it.

(August 06, 2019 - Sarah Abu-Shaaban)

(Kitco News) - Investors should diversify away from the U.S. dollar and increase their exposure to other major currencies and gold, according to a report from JP Morgan.

In a recent market note, the bank stated that it sees the U.S. dollar losing its status as the world’s dominant currency, and consequently depreciating in value.

“There is nothing to suggest the dollar dominance should remain in perpetuity,” the note said. “In fact, the dominant international currency has changed many times throughout history going back thousands of years as the world’s economic center has shifted.”

JP Morgan attributed the dollar’s decline to China’s emerging role as an economic power, a trend that can be traced back to after the Second World War, as China “has been at the epicenter of [a] recent economic shift driven by the country’s strong growth and commitment to domestic reforms.”

“China is no longer just a manufacturer of low cost goods as a growing share of corporate earnings is coming from “high value add” sectors like technology,” said JP Morgan commodities and rates strategist Craig Cohen.

In the past, China’s low-value added sectors accounted for the majority of the country’s earnings, but in the last 12 years, the ratio between aggregate net profits for low-value and high-value added sectors has steadily become more balanced. The economies of Asia as a whole, the note stated, now account for 50% of global GDP and two-thirds of global economic growth.

“Of the estimated $30 trillion in middle-class consumption growth between 2015 and 2030, only $1 trillion is expected to come from today’s Western economies,” Cohen said.

This region’s future growth will lead to less USD transactions, ultimately “eroding the dollar’s ‘reserveness’,” and further devaluating the greenback.

“In the coming decades we think the world economy will transition from U.S. and USD dominance toward a system where Asia wields greater power,” he said. “In currency space, this means the USD will likely lose value compared to a basket of other currencies, including precious commodities like gold.”

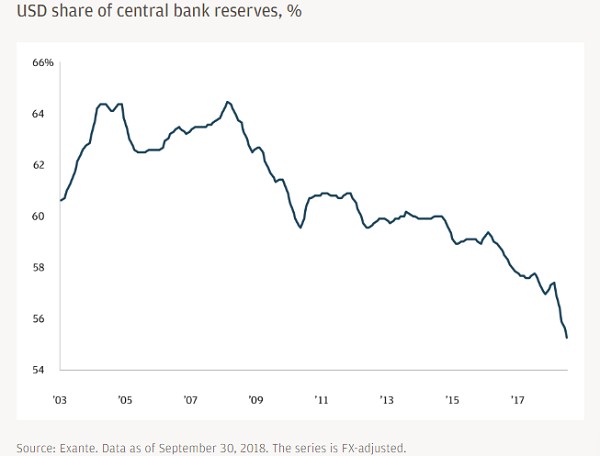

Recent data on currency reserve holdings revealed that central banks were increasingly diversifying away from the U.S. dollar, increasing their gold reserves at a record pace while also selling their dollars and buying euros, Cohen pointed out.

“To us, this makes sense: gold is a stable source of value with thousands of years of trust among humans supporting it,” he said.

“To us, this makes sense: gold is a stable source of value with thousands of years of trust among humans supporting it,” he said.

The bank stated that the current economic environment suggests portfolios should allocate more diversified exposure to other G10 currencies, currencies in Asia, and gold.