October Sets Gold Investing's Best Run In 7 Years

(November 05, 2019 - Adrian Ash of BullionVault )

The Gold Investor Index up 4 months running...

GOLD INVESTING among private individuals outpaced investor selling by a wider margin in October, writes Adrian Ash at BullionVault.

Precious metals sentiment up to its highest level since mid-2018 and extended its gains to 4 months running – the longest stretch since autumn 2012.

The index rises or falls depending on how far people buying gold outnumber those choosing to sell as a proportion of all existing gold owners at month's start.

This June it fell to just 49.1, showing more sellers than buyers with only the second sub-50 reading in the series' 10-year history.

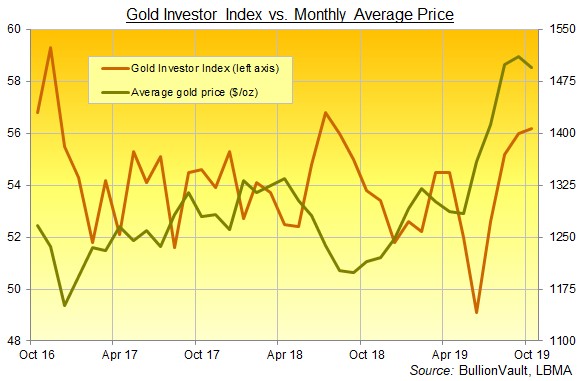

But rising all through the third quarter of 2019, the Gold Investor Index has now risen again in October, edging 0.2 points higher to 56.2, the highest reading since July 2018.

This stretch of net growth in gold investing has come even as US stocks set new all-time highs and global equity markets neared their record peaks of early 2017.

It also came as gold prices held at what would have been multi-year or record highs until this autumn's earlier peak. Wholesale bullion prices (at which you can trade 1 gram upwards using BullionVault) dropped just 1.1% on a daily average basis from September's 6.5-year high.

Yet gold investing demand was also strong by weight, adding another 309 kilos in October to BullionVault client holdings.

This extends the change in gold investing behaviour seen across Q3 2019, breaking from the previous pattern of bargain-hunting and profit-taking shown by Western investors since Trump's election victory in late 2016.

Over the last 3 months in fact, gold prices averaged $1501 per ounce, a rise of 24.6% from the August-October period last year. Demand to invest in gold, net of customer selling on BullionVault – the world's largest online platform for physical precious metals – meantime showed its strongest 3-month inflows since Christmas 2017, up 0.7 tonnes to 38.6 tonnes.

That contrasts sharply with gold coin and small-bar demand. Year-on-year, the Perth Mint in No.2 gold-mining nation Australia saw 26.9% drop in August-October gold sales. The US Mint reports a 71.2% drop in sales of new gold Eagle and Buffalo coins.

Why the split?

Gold products aimed at retail investors already saw global demand fall 25% year-on-year in Q3 2019 according to specialists GFMS at data providers Refinitiv. Separate analysis published by the mining-industry backed World Gold Council says the plunge in gold coin and small bar demand was twice as bad as that . Both analyses also say that jewellery demand sank too, and both blame that on 2019's high and record gold prices for Chinese and Indian consumers. Similarly, the WGC blames the "multi-year low" in quarterly retail investing worldwide on prices too, because that led private households "across the globe...to defer purchases and lock in profits."

Gold-price tracking ETF funds, in contrast – such as the GLD and IAU trust funds traded on the New York Stock Exchange – saw their heaviest net inflows since the start of 2016. And like those ETFs (only with outright ownership, a choice of global locations, 24/7 trading, direct access to the spread, and lower ongoing charges) BullionVault appeals to the wider investing public, rather than coin collectors or less generalist gold-focused buyers.

The vast majority run their own portfolio, picking funds or shares for growth, and tending to invest in gold as a way of balancing risk from other assets in their retirement savings, most especially equities and bonds. As we noted above, global stock markets have rarely been higher than today. Bond prices are also at record highs, driving the yield offered to investors below zero in real terms – after you account for inflation – on 4/5th of rich-world government debt according to the World Gold Council's inhouse analysts.

Why not start or add a little more gold to your savings? History says it has helped cut losses dramatically when over-priced financial markets took a tumble in the past. Especially an extended tumble over several years rather than just days or weeks.

All this said – and thanks to that more cautious profit-taking behaviour seen among generalist investors earlier in 2019's gold price rally – BullionVault users' holdings of the precious metal still remain smaller from this time last year, down by 0.5 tonnes due to the profit-taking seen earlier in 2019.

What's more, the number of people adding or starting to buy investment gold did edge lower in October, slipping for the second month running to 3.3% fewer than September and 11.6% fewer than August's near 3-year high.

But the number of sellers once again fell much harder, down 26.0% for the month and coming 45.6% below August's number at the fewest since April.

The number of first-time bullion investors fell too, dropping 29.2% in October from September and totalling barely half of August's 6.5-year peak.

But led by continued strength in new interest across the Eurozone, the global total of first-time BullionVault users remained 14.8% ahead of the prior 12 months' average and 7.5% ahead of the last 5 years' monthly average.

Trading volumes in gold meantime fell by just over one-fifth for the second month running, but they remained 14.9% above the previous 12-month average on BullionVault, with customers trading £1.9m of gold on a daily basis in October ($2.4m, €2.2m, ¥264m).

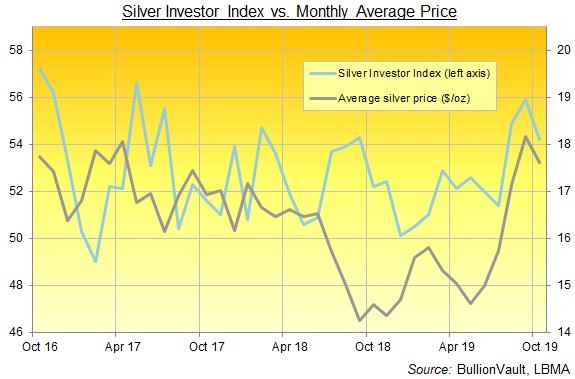

Silver also saw the number of buyers retreat for the second month running in October, totaling 27.4% fewer than September and down by almost one-third from August's near 3-year high.

The number of silver sellers fell harder however, down 35.6% from September to the fewest since May.

That still left the Silver Investor Index softer in October, falling to 54.2 from the 2-year high of 55.9 reached in September. But with silver prices also slipping last month – down 3.0% from the highest US Dollar daily average in 3 years – October marked the 3rd month running that the Silver Investor Index moved in the same direction as silver's underlying price, something not seen since New Year 2016.

Silver demand was also weaker by weight in October, with BullionVault's user holdings left unchanged from end-September at 802 tonnes. Whereas in gold, BullionVault users raised their allocations even as equity markets rose, and geopolitical risk paused with both the delay to Brexit and rumours of a US-China trade deal.

Yes, spreading risk with gold would have been cheaper before the summer. But the level of risk in equities has also risen as stocks reached new multi-year and record highs.